-

Aviation Advisory

Our dedicated Aviation Advisory team bring best-in-class expertise across modelling, lease management, financial accounting and transaction execution as well as technical services completed by certified engineers.

-

Consulting

Our Consulting team guarantees quick turnarounds, lower partner-to-staff ratio than most and superior results delivered on a range of services.

-

Business Risk Services

Our Business Risk Services team deliver practical and pragmatic solutions that support clients in growing and protecting the inherent value of their businesses.

-

Deal Advisory

Our experienced Deal Advisory team has provided a range of transaction, valuation, deal advisory and restructuring services to clients for the past two decades.

-

Forensic Accounting

Our Forensic and Investigation Services team have targeted solutions to solve difficult challenges - making the difference between finding the truth or being left in the dark.

-

Financial Accounting and Advisory

Our FAAS team designs and implements creative solutions for organisations expanding into new markets or undertaking functional financial transformations.

-

Restructuring

Grant Thornton is Ireland’s leading provider of insolvency and corporate recovery solutions.

-

Risk Advisory

Our Risk Advisory team delivers innovative solutions and strategic insights for the Financial Services sector, addressing disruptive forces, regulatory changes, and emerging trends to enhance risk management and foster competitive advantage.

-

Sustainability Advisory

Our Sustainability Advisory team works with clients to accelerate their sustainability journey through innovative and pragmatic solutions.

-

Asset management Asset management of the futureIn today’s global asset management landscape, there is an almost constant onslaught of change and complexity. To combat such complex change, asset managers need a consolidated approach. Read our publication and find out more about what you can achieve by choosing to work with us.

Asset management Asset management of the futureIn today’s global asset management landscape, there is an almost constant onslaught of change and complexity. To combat such complex change, asset managers need a consolidated approach. Read our publication and find out more about what you can achieve by choosing to work with us. -

Internal Audit Maintaining Compliance with New EU Pension Directive IORP IIOn 28 April 2021, the Irish Government transposed IORP II (Institution for Occupational Retirement Provision), an EU directive on the activities and supervision of pension schemes, into law.

Internal Audit Maintaining Compliance with New EU Pension Directive IORP IIOn 28 April 2021, the Irish Government transposed IORP II (Institution for Occupational Retirement Provision), an EU directive on the activities and supervision of pension schemes, into law. -

Risk, Compliance and Professional Standards FRED 82 – Periodic Updates to FRS 100 – 105The concept of a new suite of standards for the UK and Ireland, aligning with international financial reporting standards, was first conceived in 2002

Risk, Compliance and Professional Standards FRED 82 – Periodic Updates to FRS 100 – 105The concept of a new suite of standards for the UK and Ireland, aligning with international financial reporting standards, was first conceived in 2002 -

Audit and Assurance Auditor transition: how to achieve a smooth changeoverAppointing new auditors may seem like a daunting task that will be disruptive to your business and a drain on the finance function. Nevertheless, there are a multitude of reasons to consider a change, including simply seeking a ‘fresh look’ at the business.

Audit and Assurance Auditor transition: how to achieve a smooth changeoverAppointing new auditors may seem like a daunting task that will be disruptive to your business and a drain on the finance function. Nevertheless, there are a multitude of reasons to consider a change, including simply seeking a ‘fresh look’ at the business.

-

Corporate Tax

Our Corporate Tax team is made up of more than 40 highly experienced senior partners and directors who work directly with a wide range of domestic and international clients; covering Corporation Tax, Company Secretarial, Employer Solutions, Global Mobility and Tax Incentives.

-

Financial Services Tax

The Grant Thornton team is made up of experts who are fully up to date in terms of changing and evolving tax legislation. This is combined with industry expertise and an in-depth knowledge of the evolving financial services regulatory landscape.

-

International Tax

We develop close relationships with clients in order to gain a deep understanding of their businesses to ensure they make the right operational decisions. The wrong decision on how a company sells into a new market or establishes a new subsidiary can have major tax implications.

-

Private Client

Grant Thornton’s Private Client Services team can advise you on all areas of financial, pension, investment, succession and inheritance planning. We understand that each individual’s circumstances are different to the next and we tailor our services to suit your specific needs.

-

VAT

Grant Thornton’s team of indirect tax specialists helps a range of clients across a variety of sectors including pharmaceuticals, financial services, construction and property and food to navigate these complexities.

Innovative ways to grow your foot-print

With research suggesting that it could take up to 24 months for auto finance and leasing markets to regain pre-pandemic levels of momentum, sector players should consider alternative ways to raise capital and grow their portfolio. The demand for asset backed securitisations and receivables financing is expected to rise as it provides an opportunity for participating parties to grow their footprint inorganically. During this uncertain time, Grant Thornton recognise the need for insightful and flexible solutions for the automotive industry, leasing companies and traditional retail banks to ensure our clients are best positioned to capitalise on the emerging future opportunities for market success.

Market Impacts and Covid-19

The auto finance and leasing market has become extremely competitive in recent years, with OEM captive finance companies accounting for over 40% of the market in Ireland. They have become finance and leasing industry leaders, as they can provide a full range of financing solutions, resulting in end-to-end control of the value chain across manufacturing, finance, distribution and customer relationships.

In addition to providing a fleet distribution network for OEMs, several dealers have branched out into the leasing market, directly accounting for 10% of the market. These dealership’s hold long established relationships in the industry, and benefit from their existing sales channel and showroom infrastructure.

A number of domestic and international banks and credit providers are also increasingly active in the market, providing direct asset financing as well as finance to dealers and distributors to support stock funding and customer credit. However, with Ulster Bank’s exit on the on the horizon, there is an opportunity for challenger banks and finance houses to acquire additional market share.

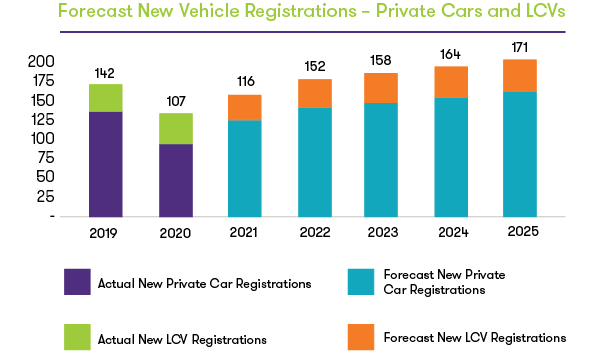

Along with increased competition, Covid-19 has had a significant impact on the auto finance and leasing sector with forecourts closed for significant periods over the last 12 months, leading to a 25% decline in new car registrations and a 16% decline in LCV registrations for the year. With similar forecasts expected for 2021, now is the time to look at alternative options to reach your sales targets.

Asset Backed Securitisations and Receivables Financing

Securitisation is the process of taking an illiquid asset and transforming it (or them) into a security. A marketable financial instrument is designed by merging or pooling various financial assets into one group. This group of repackaged assets is then sold to investors in the market, freeing up capital for the seller to pursue other strategies and providing the investor with instant portfolio growth and a larger market share.

Asset backed receivables financing is a transaction of similar structure, however, the assets remain on the vendor’s balance sheet and are not physically transferred to the purchasing party or an SPV. With receivables financing, there is an assignment of receivables rather than a transfer of assets, meaning that the rights to any future monies earned from the asset backed finance products in the portfolio are assigned to the investor.

In many cases asset backed securitisations and receivables financing transactions are of a non disclosed nature, meaning there is no impact from an end customer perspective as the originator retains and maintains the customer relationship or outsources to a third party servicer without disclosing that the rights to their payments have been transferred to the investor.

Transactions of this nature offer cash flow opportunities for investors and frees up capital for the seller, both of which promote liquidity in the marketplace and make it a compelling transaction to engage in in the current climate.

Securitisations and receivables financing are growing in popularity, with First Citizen Ireland raising €176 million in 2020 through an auto loan securitisation and Blue Motor Finance in the UK completing a £190 million auto loan securitisation in the same year, comprising of 100% fully amortising hire purchase contracts. We have observed a growth in these transactions across Europe with FCA Bank Deutscheland in Germany engaging in a two year revolving auto securitisation deal and Gedsco Group in Spain securitising c. €300m of trade receivables. Although these represent larger scale transactions, there is also an active market in Europe for lower value, higher volume portfolio sales (c.€5-20 million), including within the Irish market.

There are numerous benefits to growing your balance sheet through securitisation, however the complexities of the transaction need to be fully understood and considered in conjunction with the multi-faceted impacted stakeholders.

Benefits for your Business

Asset backed securitisations and receivables financing transactions can present a quick win for both sellers and investors. Investing in a portfolio allows lenders to increase their securitised portfolio and monthly receivables without the added cost of managing a book of individual customers and the operational risks associated with this. It can also provide instant growth in market share, and enables portfolio diversification by providing a broader choice of equipment and assets. Investing in a securitised deal enables the buyer to tailor their investments and portfolios to align to overall strategy.

Securitisations and receivables financing allows the investor to complete the deal in a non-disclosed way, enabling them to utilise OEM captive financiers’ competitive terms and collections policies without the added cost of servicing the portfolio themselves. This is of particular interest for state-owned organisations and conservative lenders who often have to consider the reputational impacts associated with stricter default and repossession policies and can benefit from an additional portfolio with more favourable terms.

Offering fixed rate finance, securitisations improve the ability of a business to budget and forecast, improving its control over cash flow and providing instant balance sheet growth.

From the seller’s perspective, selling the rights to receivables from your assets allows you to release capital from the balance sheet, providing regulatory capital relief and freeing up working capital to pursue other strategies and business investments. Asset backed securitisations create liquidity for the business, diversify funds and reduces credit risk exposure by transferring it to the investor.

Operational Considerations

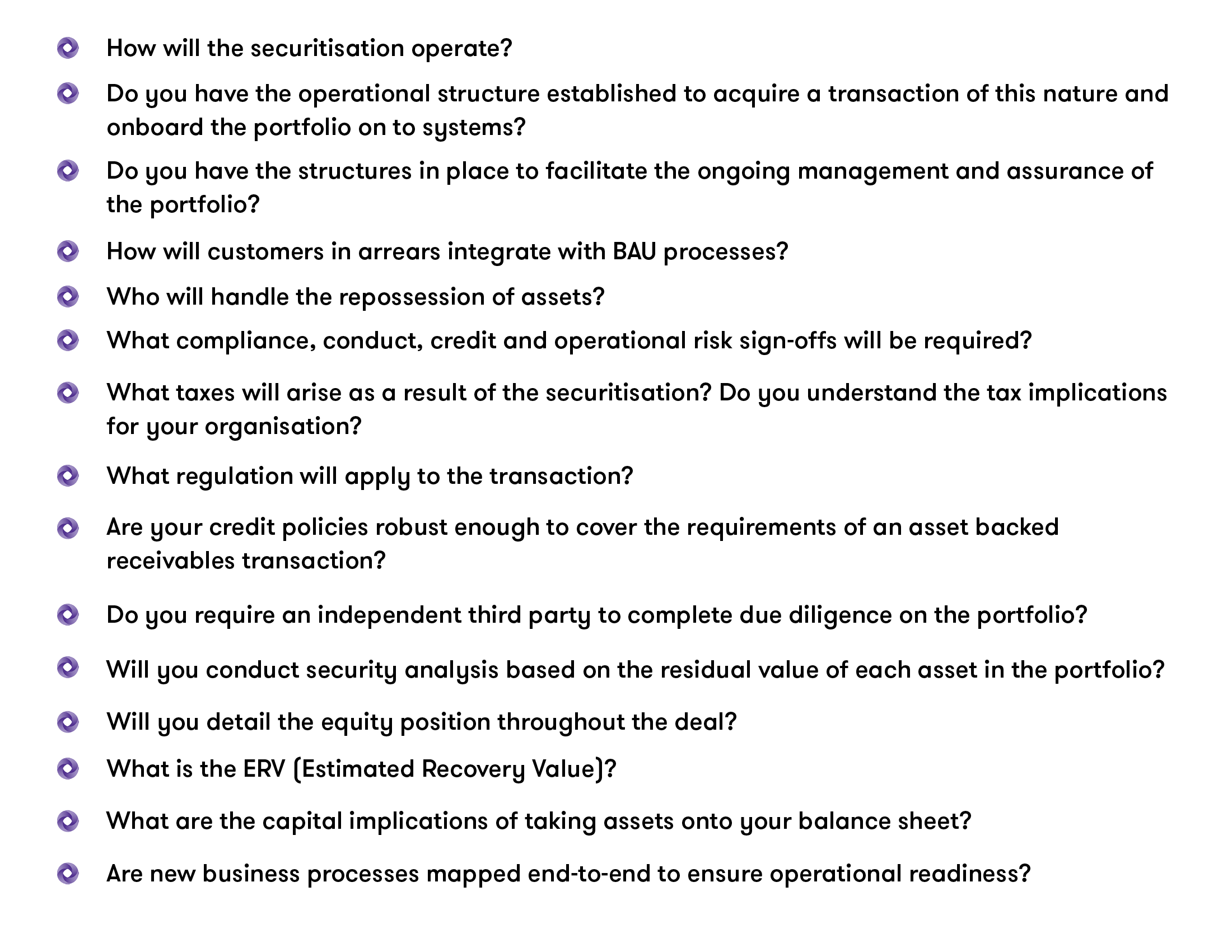

When undertaking these transactions, it is essential that there are clearly documented processes, setting out the end-to-end activity flows, with finance and risk treatments of the portfolio. There are several questions that any organisation must consider and answer to reach this end state:

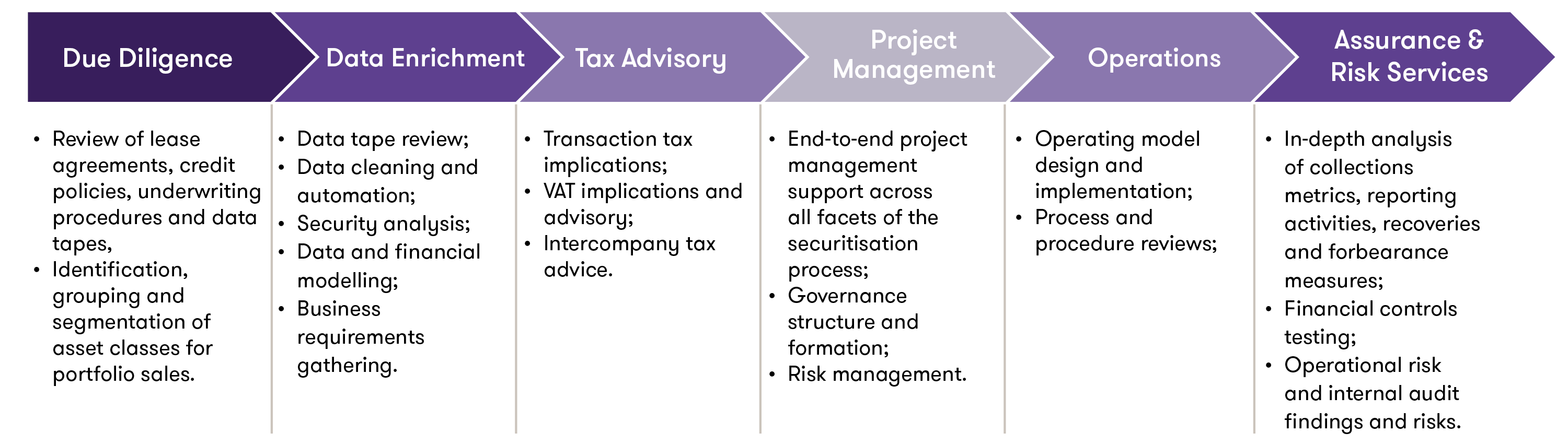

Given the benefits of these transactions for both parties, we expect the demand for securitisation and asset backed receivables financing to grow further in Ireland and beyond. Grant Thornton are uniquely placed to support your business in assessing the viability of engaging in a deal and providing end to end project management support to ensure the successful completion of same.