Introduction

The Investment Firms Regulation EU 2019/2033 (IFR) and Investment Firms Directive EU 2019/2034 (IFD) establishes a tailored prudential framework for investment firms. The new prudential regime applies to investment firms that not systemic by virtue of their size and interconnectedness within the wider financial system, i.e. primarily Class 2 type firms (see the classification criteria in our previous publication). Small and non‐interconnected investment firms may receive regulatory requirement exemption from the competent authorities.

The new regime introduces tailored liquidity requirements that are outlined in this article. In line with Article 29 of IFD, the purpose of these liquidity requirements is aiming for investment firms to maintain adequate levels of liquid resources and to have robust strategies, policies, processes and systems for the identification, measurement, management and monitoring of liquidity risk over an appropriate set of time horizons, including intra‐day.

This third publication in our series of articles by Grant Thornton, regarding the new prudential regime, focusses on the impact of the new liquidity requirements for investment firms.

Liquidity Requirements

Under the (EU) Regulation No 575/2013 Capital Requirements Regulation (“CRR”), the Central Bank of Ireland has exercised the discretion[1] to exempt investment firms, or investment firms not deemed ‘systemic’, from compliance with the liquidity reporting and funding requirements laid down in Part Six of CRR.

IFR and IFD bring change to the liquidity requirement for investment firms, requiring all investment firms to have internal procedures to monitor and manage their liquidity requirements. Those procedures should support liquidity management in an orderly manner over time so that the firm does not need to set aside liquidity specifically for times of stress.

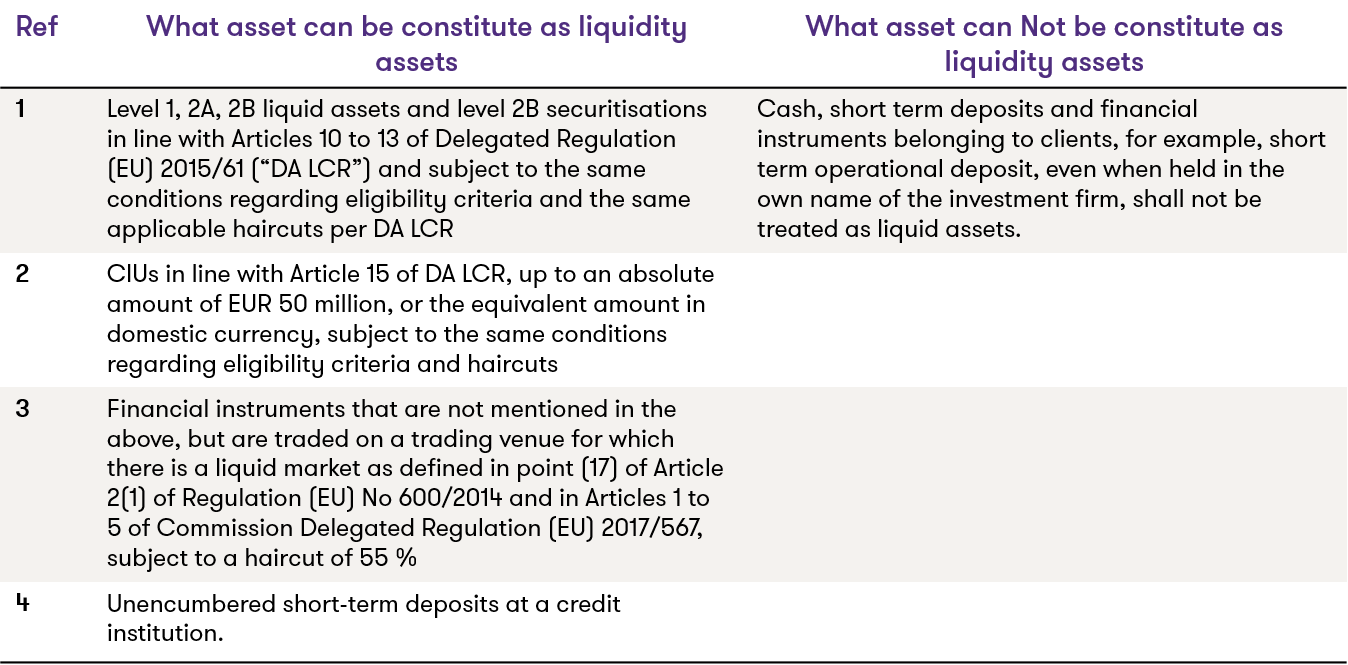

The table below shows the types of assets that can be constitute as liquidity assets in line with Article 43 of the IFR.

Table 1. Liquidity Asset definition

In line with Article 43 (1) of IFR, investment firms should hold a minimum of one third of their fixed overheads requirement in liquid assets at all times (please see our previous publication for the fixed overhead requirement). The below formulas represents the requirements.

Liquidity Assets ≥ 1/3 * Fixed Overheads Requirement

Where,

Fixed Overheads Requirement ≥ ¼ * Fixed Overheads for the Preceding Year

Small and non‐interconnected investment firms may be exempted by the competent authorities from this requirement. Although the Central Bank of Ireland is proposing not to exercise this discretion on a general basis[1], as it considers the liquidity requirements not giving rise to an excessive regulatory burden for investment firms; the discretion may be exercised on a case by case basis and it will take into account of the guidance that will be provided by the EBA and ESMA.

In line with Article 44, in exceptional circumstances, investment firms may seek permission from the competent authority to reduce the amount of liquid assets held, however, compliance to the regulatory liquidity requirements should be restored within 30 days of the original reduction.

In line with Article 45 of IFR, investment firms should increase their liquid assets by 1.6% of the total amount of guarantees provided to clients.

In line with Article 43 (3) of IFR, small and non‐interconnected investment firms and investments firms that do not deal on own account, provide portfolio management services, provide investment advice or underwrite of financial instruments and/or place of financial instruments on a firm commitment basis, may include receivables from trade debtors (such as money due from debtors for trading investment products) as well as fees or commissions receivable within 30 days in their liquid assets, if those receivables comply with the following conditions:

- they account for up to a maximum of one third of the minimum liquidity requirements;

- they are not to be counted towards any additional liquidity requirements required by the competent authority for firm‐specific risks; and

- they are subject to a haircut of 50 %.

Next Steps

The new requirements as part of the IFR/IFD prudential framework will require frequent and enhanced monitoring, calculations and reporting for impacted firms, therefore impacted firms should identify and remediate any gaps early to be in a position to comply with the IFR regime when it comes into effect in June 2021.

In doing so, impacted investment firms should take into account the additional EU Level 2 and 3 regulatory items that will be produced by the EBA in the coming months:

How Grant Thornton can help

Grant Thornton’s Financial Services Risk, Consulting and Advisory teams have supported a number of investment firms with understanding, preparing for and implementing the new prudential framework. In particular, our prudential risk experts have extensive knowledge of the relevant legislation and guidance and the challenges these pose to your firm.

Our experts can help your firm assess its regulatory requirements arising from the new regime and advise on methods to ensure full compliance balanced with your business needs.

[1] Implementation of Competent Authority Options and Discretions in the European Union (Capital Requirements) Regulations 2014 and Regulation (EU) No 575/2013 December 2018

[2] Consultation Paper CP135 Consultation on Competent Authority Discretions in the Investment Firms Directive and the Investment Firms Regulation