Introduction

The Investment Firms Regulation EU 2019/2033 (IFR) and Investment Firms Directive EU 2019/2034 (IFD) establishes a tailored prudential framework for investment firms. As outlined in our previous publication, the new prudential regime for investment firms applies to class 2 & firms primarily, which are not systemic by virtue of their size and their interconnectedness within the wider financial system.

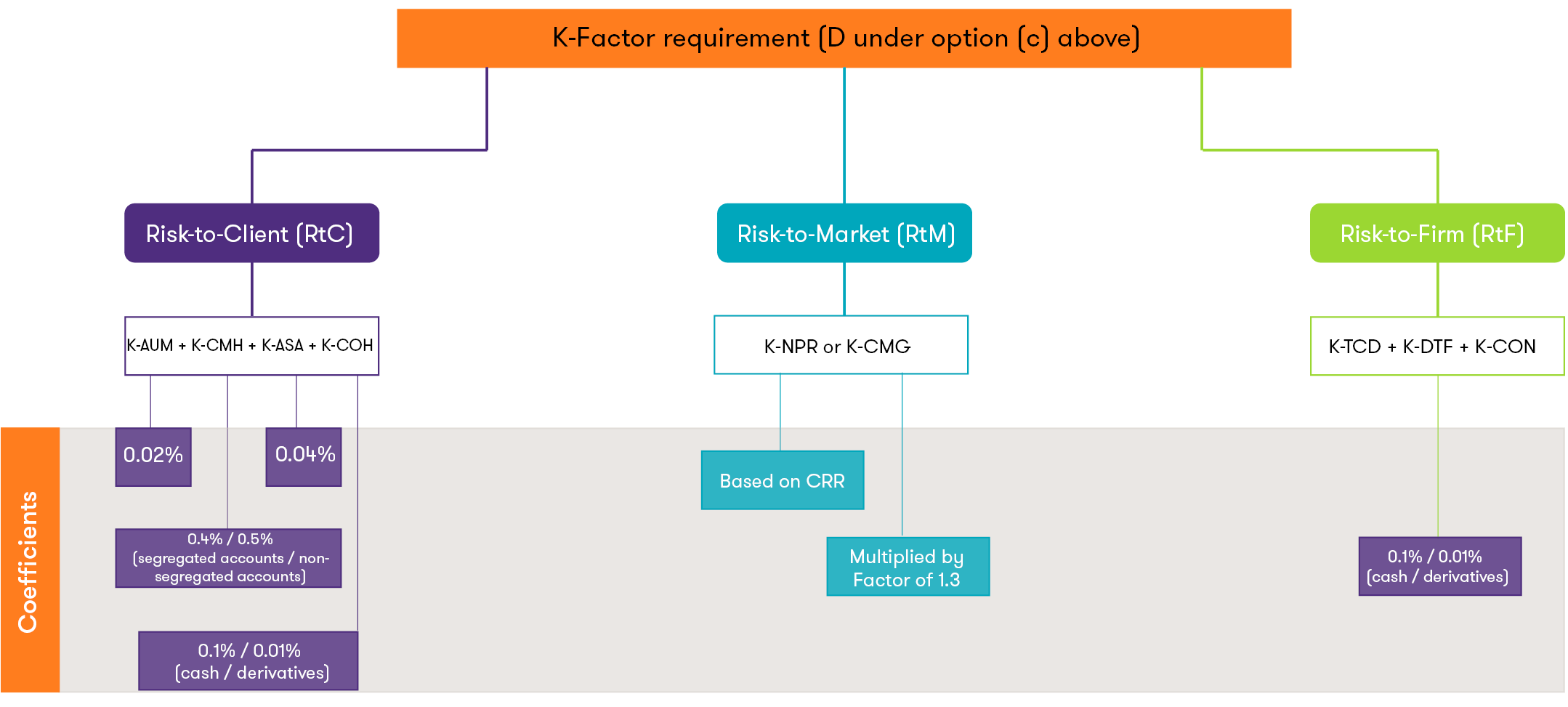

The new regime introduces tailored capital requirements based on three macro-risk areas (i.e.: risk to client, risk to market and risk to firm) that are outlined within this article.

This second publication in our series of articles by Grant Thornton, regarding the new prudential regime, focusses on the impact of the new capital requirements for investment firms.

Capital Requirements

Investment firms shall, at all times, have Own Funds to meet their capital requirements “D”; where D is the highest of the following: (a) their fixed overheads requirement; (b) their permanent minimum capital requirement; or (c) their K‐factor requirement (outlined below).

Figure 1 Capital Requirements overview

Fixed Overheads Requirements

As per Article 13 of the IFR, Fixed Overhead Requirements (FOR) is the amount equal to at least one quarter of the investment firm’s fixed overheads for the preceding year. Further regulatory requirements on the FOR will be prescribed by the draft RTS[1] being reviewed by the EBA.

Initial Capital Requirements

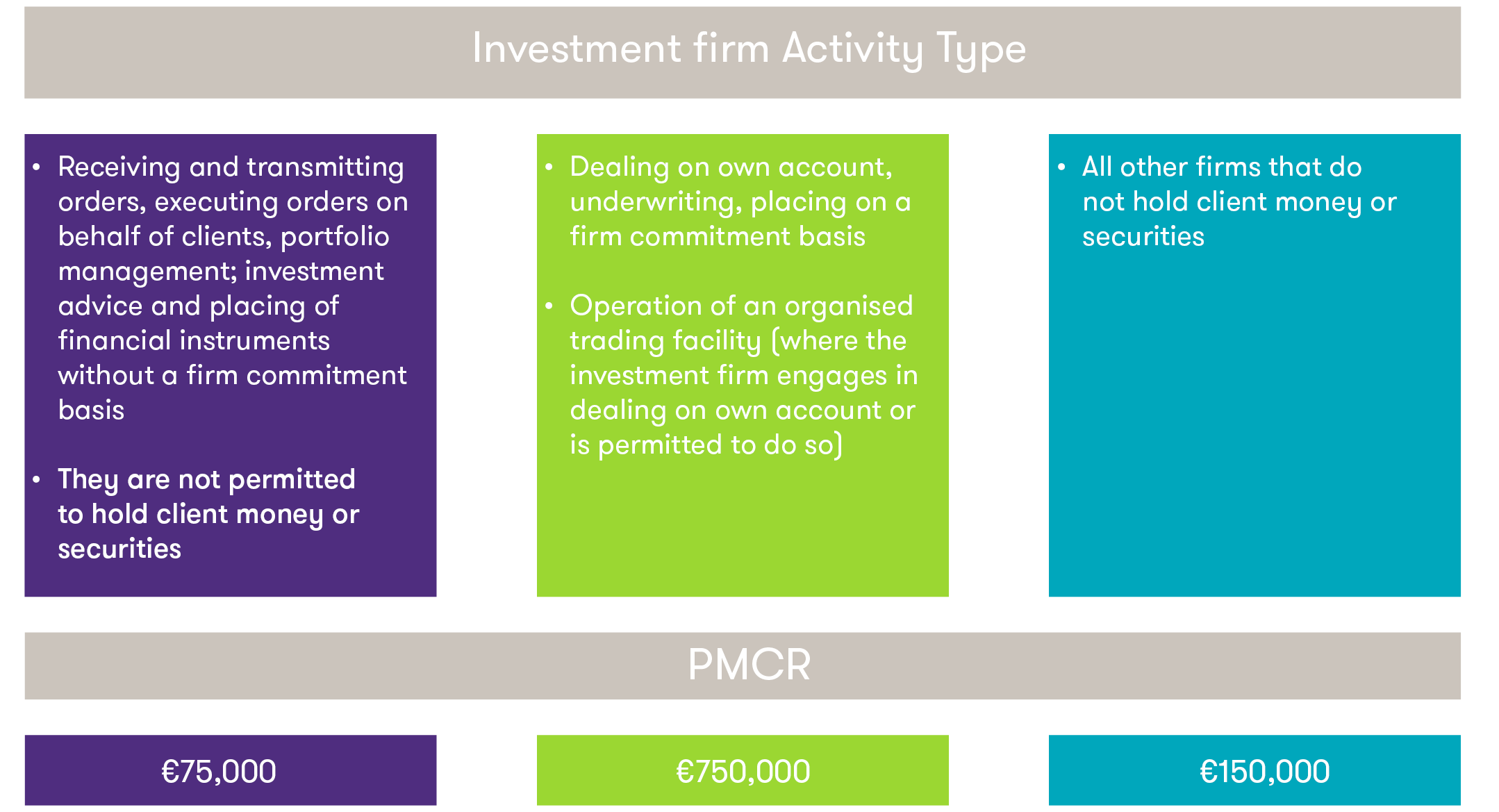

The IFR/IFD requires that the current minimum capital requirement bandings, for those under IFD/IFR (Class 2 and Class 3 firms) would increase, compared to the prescriptions of the CRD IV, from €730K to €750K, from €125K to €150K and from €50K to €75K respectively.

Minimum capital requirements are aligned with initial capital requirements, whereby the permanent minimum capital requirement (“PMCR”) amounts to at least the specific level of initial capital required.

Pursuant to Article 9 of the IFD, the initial capital requirement is set out and is based on the MiFID II services that an investment firm is authorised or plans to offer.

Figure 2 Permanent minimum capital requirement

K-Factors requirements

K-factors are quantitative indicators that aim to identify risks that an investment firm may pose to clients, markets or liquidity, as well as to the firm itself.

Specifically, K-factors are divided in the IFR into three groups and they aim to capture the risks the firms may be exposed to.

Figure 3 K-Factor overview

The overall K-factor position is a sum of the K-factors in respect of the three areas of risk outlined (RtC, RtM and RtF) as outlined in Article 15 of the IFR.

The K-factors and coefficients that are applied to each factor are outlined above.

Risk to Client (RtC)

RtC is the sum of client assets under management (K-AUM), client money held (K-CMH), assets safeguarded and administered (K-ASA), and client orders handled (K-COH), multiplied by coefficients as outlined in Article 15 of the IFD and set out in Figure 2 above.

It is noted that the RtC covers the full spectrum, and different MiFID services, of the way investment firms service their clients.

In order to provide prescriptive rules, with the aim of a uniformed adoption of the IFR in the EU, the EBA is finalising two Regulatory Technical Standards on the methods for measuring the K-factors and definition of segregated account. The EBA has delivered the final draft of these RTS to the European Commission in December 2020 and the European Commission will evaluate the same for implementation.

Risk to Market (RtM)

The RtM K‐factor requirement applies to all trading book positions, which include in particular positions in debt instruments (including securitisation instruments), equity instruments, collective investment undertakings (CIUs), foreign exchange and gold, and commodities (including emission allowances) and comprises of net position risk (K-NPR) and clearing member risk (K-CMG).

The K‐factor under RtM captures K-NPR in accordance with the market risk provisions of Regulation (EU) No 575/2013 (Capital Requirements Regulation) or, where permitted by a competent authority for specific types of investment firms which deal on own account through clearing members.

The RtM K‐factor requirement for the trading book positions of an investment firm dealing on own account, whether for itself or on behalf of a client shall be either K-NPR or K-CMG which are to be calculated in accordance with Article 22 and Article 23 of the IFR respectively.

It is worth noting for impacted firms that the RtM K‐factor requirement applies to all trading book positions, which include in particular positions in debt instruments (including securitisation instruments), equity instruments, collective investment undertakings (CIUs), foreign exchange and gold, and commodities (including emission allowances).

For the purpose of calculating the RtM K‐factor requirement, an investment firm shall include positions other than trading book positions where those give rise to foreign exchange risk or commodity risk.

Those requirements apply to investment firms dealing on own account for itself or on behalf of a client.

Risk to Firm (RtF)

As per Article 24 of the IFD, the RTF K-factor requirement is the sum of Trading Counterparty default risk (K-TCD), Daily Trading Flow (K-DTF) and Concentration Risk (K-CON).

As outlined within the IFD, the objective of K‐TCD (trading counterparty default) is to capture the risk to an investment firm by counterparties to over‐the‐counter (OTC) derivatives, repurchase transactions, securities and commodities lending or borrowing transactions, long settlement transactions, margin lending transactions or any other securities financing transactions.

As well as this, K-TCD aims to capture the additional risk posed by recipients of loans granted by the investment firm on an ancillary basis as part of an investment service that fail to fulfil their obligations, by multiplying the value of the exposures, based on replacement cost and an add‐on for potential future exposure, by risk factors based on the Capital Requirements Regulation, accounting for the mitigating effects of effective netting and the exchange of collateral.

K‐DTF captures the operational risks to an investment firm in large volumes of trades concluded for its own account or for clients in its own name in one day which could result from inadequate or failed internal processes, people and systems or from external events, based on the notional value of daily trades, adjusted for the time to maturity of interest rate derivatives in order to limit increases in own funds requirements, in particular for short‐term contracts where perceived operational risks are lower.

It is important for impacted firms to note that all investment firms should monitor and control their concentration risk, including in respect of their clients. However, only investment firms which are subject to a minimum own funds requirement under the K‐factors should report to competent authorities on their concentration risks.

For investment firms specialised in commodity derivatives or emission allowances or derivatives thereof with large concentrated exposures to non‐financial counterparties, the limits for concentration risk may be exceeded without additional capital under K‐CON as long as they serve commercial, treasury or risk management purposes.

Who do the K-factor requirements apply to?

As outlined in our previous publication, Class 2 firms will be required to calculate their capital requirement based on the K-factor formula.

Class 3 firms are not required to calculate their capital based on the K-factor formula, however they will have to demonstrate the ability to monitor elements of data required by the K-factors in order to assess the circumstances where they may at a point in time become a class 2 investment firm. This is something that class 3 firms should keep closely under review.

Next Steps

The new requirements as part of the IFR/IFD prudential framework will require frequent and enhanced monitoring, calculations and reporting for impacted firms, therefore impacted firms should identify and remediate any gaps early to be in a position to comply with the IFR regime when it comes into effect in June 2021.

How Grant Thornton can help

Grant Thornton’s Financial Services Risk, Consulting and Advisory teams have supported a number of investment firms with understanding, preparing for and implementing the new prudential framework. In particular, our prudential risk experts have extensive knowledge of the relevant legislation and guidance and the challenges these pose to your firm.

Our experts can help your firm assess its regulatory requirements arising from the new regime and advise on methods to ensure full compliance balanced with your business needs.

[1] Draft RTS to supplement the calculation of the fixed overheads requirement

See our Financial Services Advisory webpage