Sign up for expert insights, industry trends, and key updates—delivered straight to you.

In July 2021 the European Banking Authority (EBA) jointly with the European Securities and Markets Authority (ESMA), published the final Guidelines on common procedures and methodologies for the supervisory review and evaluation process (SREP) for investment firms (EBA/GL/2022/09).

Along with these guidelines the EBA also published the final draft Regulatory Technical Standards (RTS) on Pillar 2 add-ons for investment firms (EBA/RTS/2022/07). The aim of both of these regulatory products is to harmonise the supervisory practices regarding the supervisory review and evaluation process of investment firms.

Supervisory review and evaluation process (SREP)

SREP is one of the main tools for supervision, through which competent authorities form a comprehensive view on the business model and risk profile of the supervised entity, as well as its overall viability and sustainability.

These guidelines, drawn up pursuant to subparagraph 4 of Article 45(2) of Directive (EU) 2019/2034 on the prudential supervision of investment firms, are addressed to competent authorities and intend to promote common practices for the SREP referred to in Article 36 of Directive (EU) 2019/2034.

The guidelines specify common procedures and methodologies for SREP which are proportionate to the different sizes and business models of investment firms, and the nature, scale and complexity of their activities. Investment firms are classified into four distinct categories, which translates into different frequency, depth and intensity of the assessments, and the engagement of the competent authority.

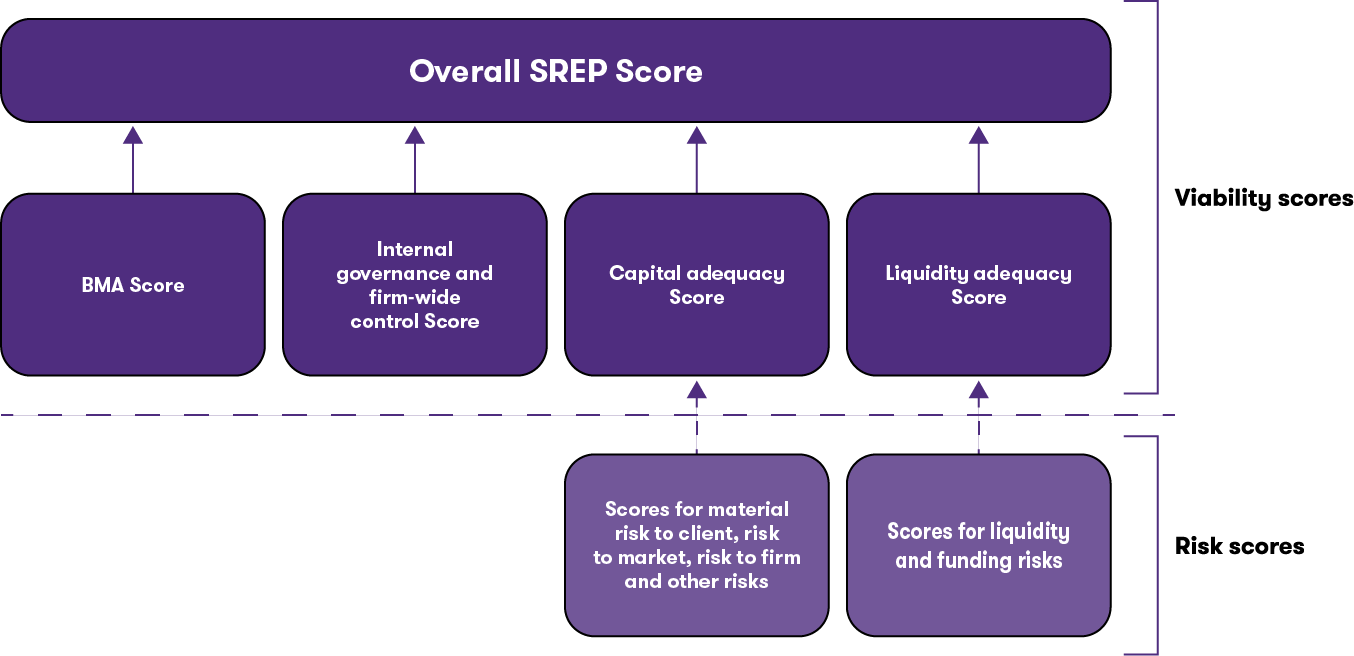

The framework of the guidelines is built around 4 main elements:

- business model analysis;

- assessment of internal governance and investment firm-wide control arrangements;

- assessment of risks to capital and adequacy of capital to cover these risks; and

- assessment of risks to liquidity and funding and adequacy of liquidity resources to cover these risks

The consistency and comparability of assessment is facilitated by the common scoring framework, differentiating between risks and viability scores. The scores of individual risks and SREP elements are brought together to form an overall SREP score, reflecting the assessment of the viability of the investment firm.

These guidelines are addressed to competent authorities supervising class 2 and class 3 investment firms and specify the procedures and methodologies for the supervisory review and evaluation of these firms. The main objective of these guidelines is to ensure consistency in supervisory practices in the assessment of class 2 and class 3 investment firms and in the application of capital and other supervisory measures, and thus to contribute to level playing field for these investment firms across the EU.

Regulatory Technical Standards (RTS) on Pillar 2 add-ons for investment firms

The RTS on Pillar 2 add-ons for investment firms clarify how competent authorities should measure risks or elements of risks that investment firms face or pose to others, that are not covered or not sufficiently covered by the own funds requirements set out in Part Three and Four of Regulation (EU) 2019/2033 of the European Parliament and of the Council of 27 November 2019 on the prudential requirements of investment firms.

As investment firms can vary greatly in terms of size, business model, risk profile, complexity and interconnectedness the new regime for investment firms distinguishes between investment firms deemed similar in terms of business models and risk profiles to credit institutions that will remain subject to the prudential and supervisory requirements of the Regulation (EU) No 575/2013 and Directive 2013/36/EU (Class 1 investment firms), and firms that became subject to the new requirements of the Regulation (EU) 2019/2033 and Directive (EU) 2019/2034, according to their systemic importance, and other criteria including size and types of activities under Directive 2014/65/EU.

The draft RTS is relevant for class 2 and class 3 investment firms, and aim to ensure a consistent and proportionate application of supervisory practices across the Union, providing granular guidance embedding different sizes, business models, and risk profiles of the investment firms, while maintaining risk sensitivity of the calculation of capital requirements under Pillar 2. These draft RTS should be read along with the SREP guidelines under Article 45(2) of Directive (EU) 2019/2034, as the application of additional own funds requirements results from a comprehensive SREP process.

There are various objectives of the own funds requirements for class 2 and class 3 investment firms which the draft RTS differentiates between. Competent authorities must determine any additional own funds requirements to cover the risk of an orderly wind-down which could pose threats to clients, counterparties, and the wider markets in which the firm operates in case of their failure.

In relation to the second objective, which applies to class 2 investment firms only, competent authorities should determine additional own funds requirement to decrease the likelihood of a failure of the investment firm, by covering material risks related to their ongoing activities, including risks to clients, to markets, to the investment firms itself, and risks that are not addressed by any own funds requirements.

The investment firm’s total capital requirements should, at all times, be at least equal to the own funds requirements set out in Part Three and Four of Regulation (EU) 2019/2034. To that aim, the capital considered adequate to cover the risk of unorderly wind-down of an investment firm and the capital considered adequate to cover risks from ongoing activities shall at least be respectively equal to the fixed overhead requirements and K-factor requirements determined in accordance with Article 11 of Regulation (EU) 2019/2033.

In addition, investment firms may be exposed to other risks such as ICT risk, interest rate risk in the banking book or credit risk that are not addressed by the minimum own funds requirements, in cases where these risks are material in nature, competent authorities will need to assess their impact separately and consider such impact within the capital considered adequate to cover risks related to the investment firms’ ongoing activities.

What are the next steps?

Investment firms need to understand these new guidelines and draft RTS and manage their business accordingly. Firms will need to review and update their existing business plans, systems and policies to incorporate both the guidelines and draft RTS, adequate resources must be made available to incorporate changes where required.

Why Grant Thornton?

Grant Thornton’s Financial Services Risk, Consulting and Advisory teams are comprised of dedicated experts who are experienced in supporting investment firms with a variety of regulatory challenges, including those arising from the new SREP guidelines and draft RTS.

In particular, our industry-leading Prudential Risk team understand that regulation continues to drive the strategic agenda for investment firms. They specialise in assisting clients across the financial services sector in navigating through the maze of regulation and support clients to identify regulatory obligations and work towards full compliance balanced with your business needs.