Sign up for expert insights, industry trends, and key updates—delivered straight to you.

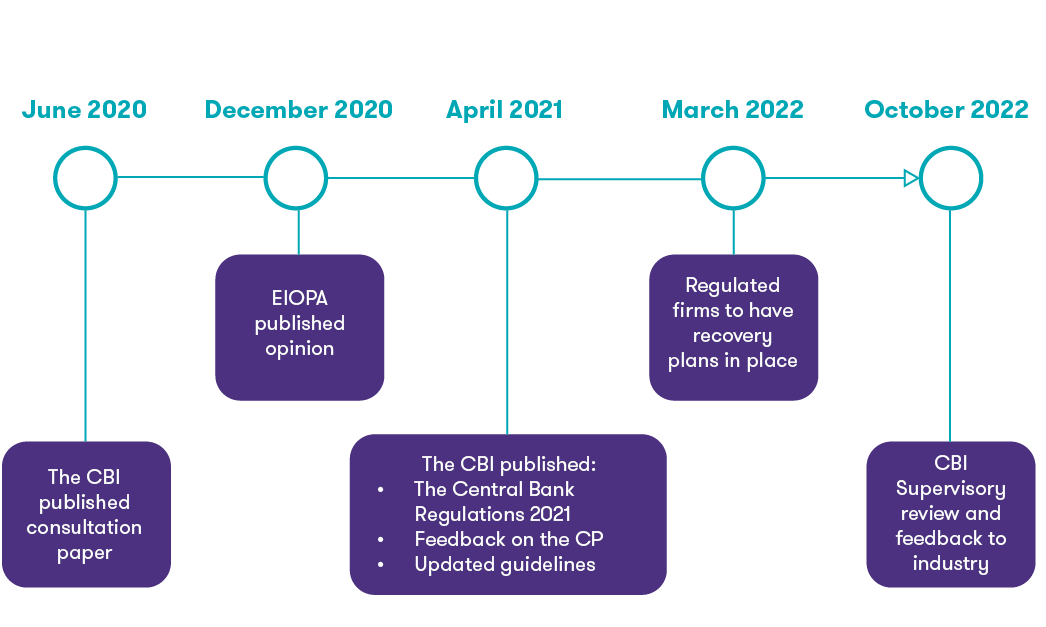

This is the first article from Grant Thornton in our series on the Central Bank of Ireland (Central Bank)’s recovery plan Requirements. This introductory article provides an overview of the key requirements of the legislation, the timelines involved and main topics included in your recovery plan.

The regulations require insurers and reinsurers to have an effective recovery framework in place in order to be able to cope under severe stress in the most appropriate and timely manner.

The recovery plan Requirements Regulations apply to insurers, reinsurers and captives (collectively (re)insurers), including branches of third-country insurance undertakings authorised by the Central Bank under the Solvency II Regulations.

Supervision teams have begun issuing individualised feedback directly to firms. Industry wide feedback from the Central Bank on the recovery plans submitted is expected in October this year. In our second article we’ll discuss the expected feedback themes in more detail.

What is recovery planning?

Recovery planning is a risk management tool that is intended to help prevent companies from having to resort to implementing resolution plans. It is part of system of governance under the Solvency II Regulations and is closely interlinked with Risk Appetite Statement and Own Risk and Solvency Assessment (ORSA).

While Risk Appetite Statements set out the risk strategy and tolerances, recovery planning focuses on identifying stresses that could arise and result in the entity going into liquidation and exploring mitigating actions (recovery options) which will stop the entity going into liquidation.

The ORSA aims to prevent (re)insurers from coming under severe stress and breaching the SCR; however, recovery planning aims to mitigate stresses and restore the financial position in the event they come under stress.

Timeline

Companies were required to have pre-emptive recovery plans in place by the end of March 2022. The plans need to comply with the requirements set out by the Central Bank.

- High and Medium-High Impact firms should have submitted their initial recovery plan to the Central Bank at the end of March 2022. The Board are to review and update the recovery plans at least annually. Subsequent versions are to be submitted to the Central Bank within one month of its approval by the Board.

- Medium-Low and Low Impact firms do not need to submit their recovery plans to the Central Bank unless requested to do so. Their recovery plans need to be reviewed and updated every two years, or in the event that there is a material change to the legal or organisational structure of the (re)insurer, its business or its financial position.

Recovery plans

This section outlines some of the key areas of regulatory focus:

- unrealistic recovery options;

- key risk indicators (KRIs); and

- the ORSA.

For a recovery plan to be of benefit to the firm, and not simply meeting a regulatory requirement, it must be realistic and aligned with the vulnerability and the recovery capability of the (re)insurer. Where vulnerabilities are identified, then what recovery options the firm could deploy for that scenario should be explored.

Existing KRIs tend to be used as a starting point when considering recovery indicators, in order to identify the progression of risks that have the potential to threaten their financial viability. However, the range of events should not only be limited to solvency, but also liquidity and operational events. Robust scenarios that could result in recovery breaches spanning system-wide and insurer-specific scenarios should be considered in the recovery plan.

Companies may have found it useful to use the existing ORSA as a starting point; however, scenarios considered under the recovery planning framework may be different from those included in the ORSA. Both slow moving and fast moving scenarios should be interrogated. In addition, scenarios in the recovery plan should consider an emerging stress over an appropriate timeframe rather than the immediate deterministic stresses frequently used in ORSA.

For a recovery plan to be beneficial it will explore what indicator could be triggered and when; what action would that prompt; what options would be deployed; and how recovery options would play out in each severe stress scenario.

The most robust recovery plans will consider the effectiveness of recovery options, their timeline and recovery capacity under different scenarios.

What next?

Firms have produced their initial recovery plans, and the industry awaits review and feedback from the Central Bank on the initial submissions in October. This will likely result in many firms making potentially significant revisions to their recovery plans.

How can we help?

Grant Thornton recognises that implementing the feedback may prove to be onerous and time consuming for (re)insurers. We understand the practical operational aspects, have recently left ex Central Bank of Ireland insurance regulators as part of our team and can assist firms in the interpretation of regulatory requirements, guidance and feedback.