Introduction

European regulatory authorities have introduced new legislation, referred to as the Investment Firms Regulation EU 2019/2033 (‘IFR’) and Investment Firms Directive EU 2019/2034 (‘IFD’), which aims to establish a tailored prudential framework for investment firms. For most investment firms, they were required to comply with the Captial Requirements Regulation (CRR), which was originally designed for large and complex banks and trading institutions.

This is the fourth publication in a series of articles by Grant Thornton and focusses on the impact of the disclosure and reporting requirements for investment firms.

The largest Systemic investment firms (Class 1 Firms) will continue to apply the currently CRR regime. The new prudential regime, IFR/D, applies to investment firms that are not considered systemic by virtue of their size and/ or interconnectedness within the wider financial system, i.e. primarily Class 2 Firms (see the classification criteria in our previous publication). Small and non‐interconnected investment firms (Class 3 Firms) may receive regulatory requirements exemptions from the competent authorities.

The new prudential regime introduces disclosure and reporting requirements. The purpose of these new requirements is to ensure that investment firms are managed in an orderly way, and the best interests of their clients and to ensure the safety and soundness of investment firms while avoiding the imposition of a disproportionate administrative burden.

Disclosure Requirements

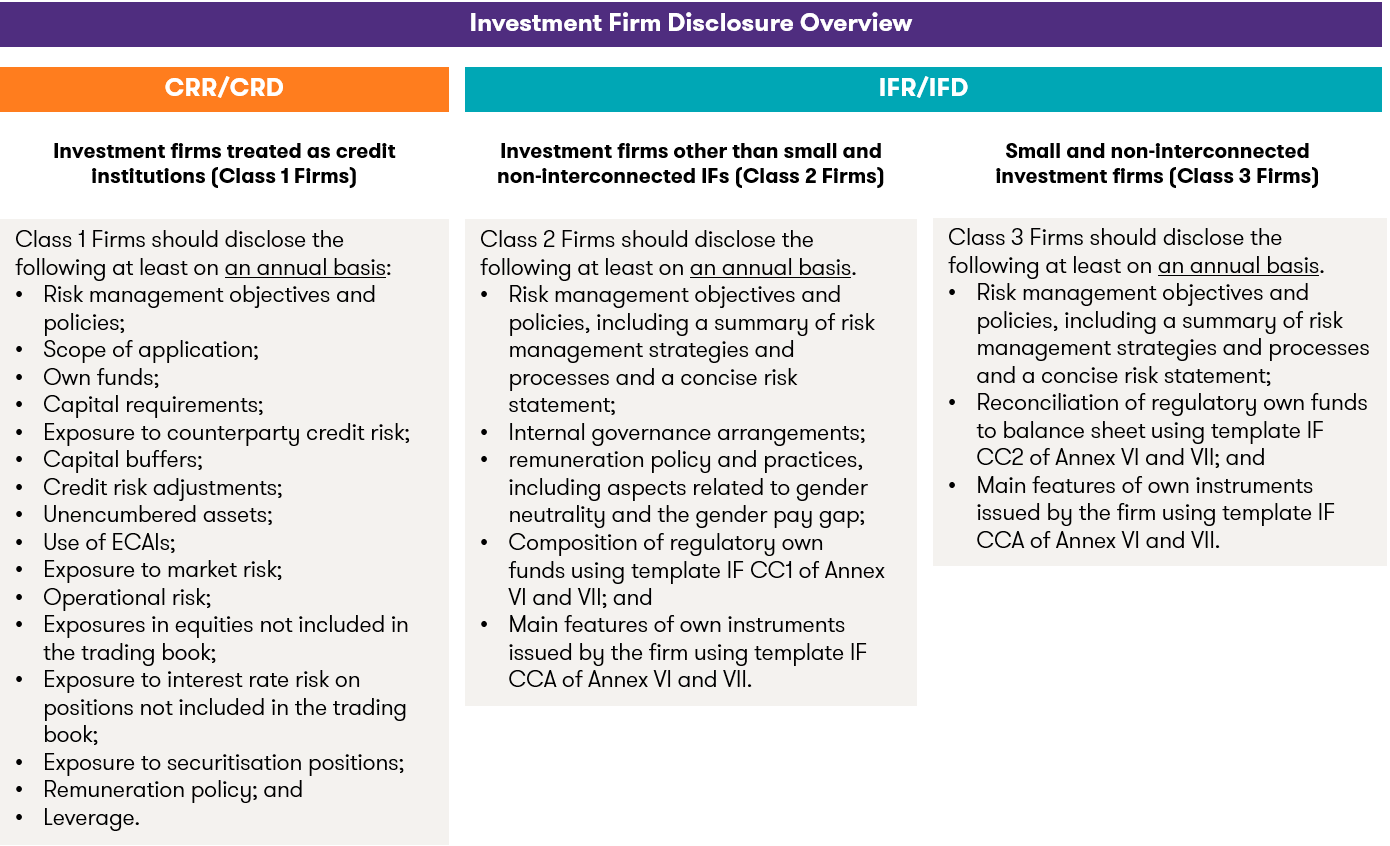

All firms that subject to IFR and IFD should publish their disclosure information on the same date as the publication of their annual financial statements and determine the appropriate disclosure medium and location. All disclosures shall be provided in one medium or location, where possible. The table below shows the disclosure requirements in line with Part Six, “Disclosure By Investment Firms”, of the IFR, and EBA Draft Implementing Technical Standards on reporting requirements for investment firms under Article 54(3) and on disclosures requirements under Article 49(2) of Regulation (EU) 2019/2033 and compares them to the existing CRR and CRD requirements.

Table 1. Disclosure Requirements

Reporting Requirements

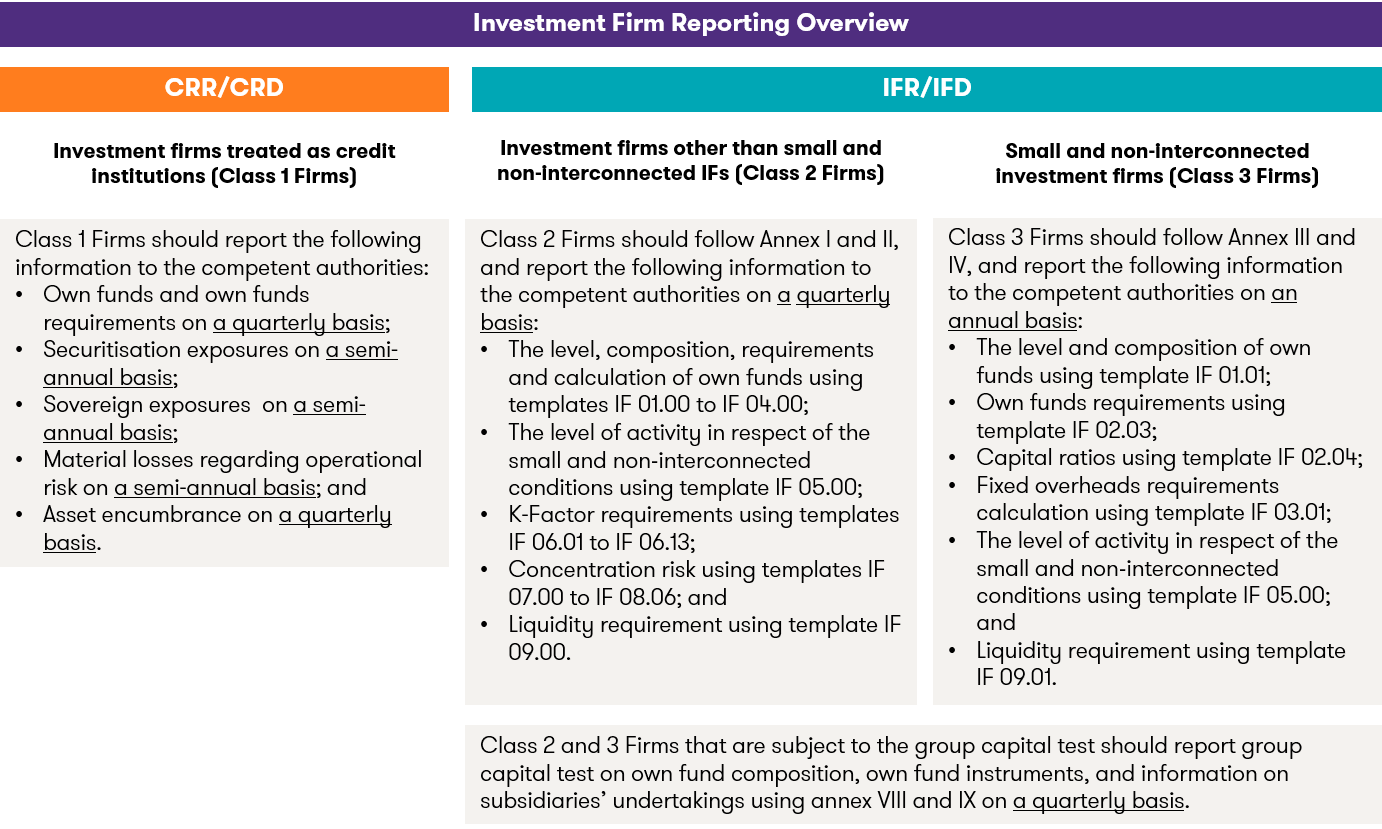

The table below shows the reporting requirements for firms subject to IFD and IFR, in line with Part Seven, “Reporting By Investment Firms” of the IFR and EBA Draft Implementing Technical Standards on reporting requirements for investment firms under Article 54(3) and on disclosures requirements under Article 49(2) of Regulation (EU) 2019/2033 and compares to the existing CRR and CRD requirements.

Table 2. Reporting Requirements

Next Steps

The new requirements as part of the IFR/IFD prudential framework will require frequent and enhanced monitoring, calculations and reporting for impacted firms, therefore impacted firms should identify and remediate any gaps early to be in a position to comply with the IFR regime when it comes into effect in June 2021.

In doing so, impacted investment firms should take into account the additional EU Level 2 and 3 regulatory items from the EBA.

How Grant Thornton can help

Grant Thornton’s Financial Services Risk, Consulting and Advisory teams currently support a number of investment firms with understanding, preparing for and implementing the new prudential framework in a practical hands on manner. In particular, our IFR/IFD experts have extensive knowledge of the relevant legislation and guidance and the challenges these pose to your firm.

Our IFR/IFD experts can help your firm assess its disclosure and regulatory requirements arising from the new regime and advise on methods to ensure full compliance balanced with your business needs and tight implementation timelines.