Subsidy payments by Revenue to employers under the Temporary Wage Subsidy Scheme (TWSS) and paid to employees are treated as part of the employees’ emoluments i.e. salary and wages, for tax purposes. The subsidy amount paid to employees via payroll was not subject to tax under the PAYE system however, the amount received by the employee is liable to income tax and Universal Social Charge (USC).

The amount of income tax and USC due on the TWSS amount will be verified by Revenue on the employees’ Preliminary End of Year Statement for 2020. This statement is expected to be available to every employee from 15 January 2021 via the Revenue’s MyAccount service. The statement will not be provided to employers. The Preliminary End of Year Statement is a preliminary calculation of the employee’s tax and USC for the year and is based on the information held on Revenue’s records. To receive a Statement of Liability an employee must complete an income tax return. Revenue said they will not issue paper notices of Preliminary End of Year Statement to individuals not registered for MyAccount. Individuals can register for MyAccount or MyGovID to view this statement.

In some cases, the income tax and USC arising on the TWSS payment may be covered by the employee’s unutilised tax credits and rate bands or by additional tax credits claimed for 2020. In other cases, the liabilities will be due to be paid to Revenue.

Paying the income tax and USC

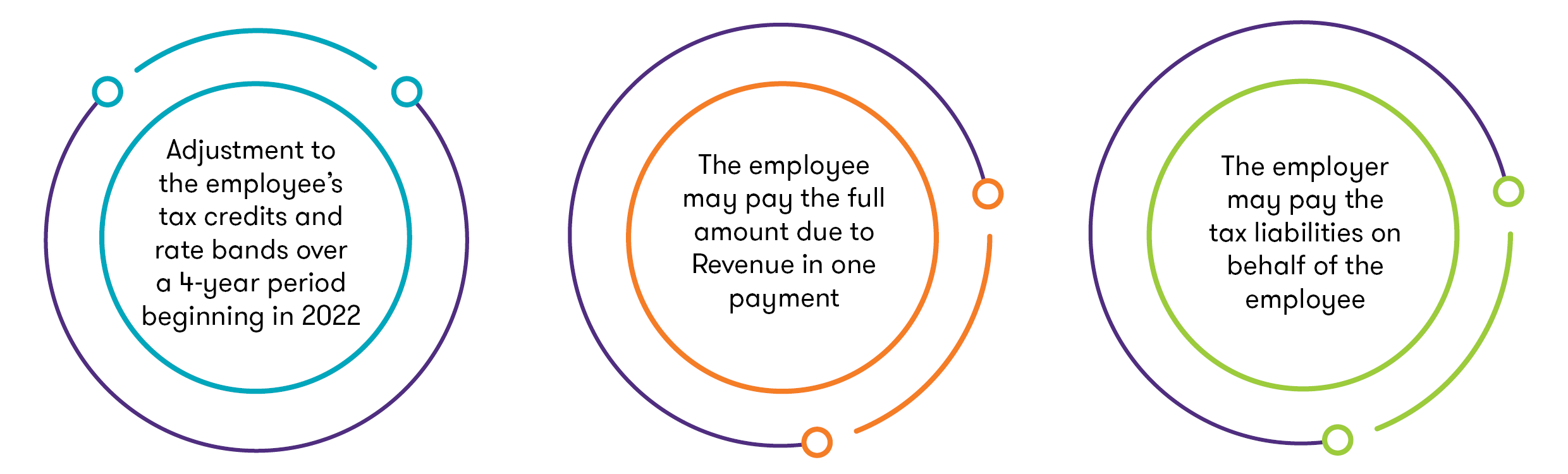

Options to pay the income tax and USC arising on the TWSS payment include:

Employers paying the TWSS tax liability

Employers can pay employees’ TWSS tax liabilities without an additional tax charge. Revenue have confirmed that no Benefit in Kind (BIK) and therefore no additional tax charge will arise for the employee where the employer pays the income tax and USC arising on the TWSS payments. Revenue have confirmed this exemption is also available where the employer partially pays the employee’s TWSS tax liabilities.

We understand that Revenue’s position is that this BIK exemption is available in respect of payments for PAYE employees only, it does not currently extend to self-assessed staff, such as proprietary directors.

- The Preliminary End of Year Statement for 2020 may assist an employer in determining the amount of income tax and USC due. The statement will issue to the employee via MyAccount, not the employer. The employer will have to verify the tax liability amount with the employee.

- Documentary evidence must be retained by the employer to demonstrate that they have engagement with their employees on this arrangement and have agreed to pay the income tax and USC on TWSS payments.

- Employers must engage directly with employees and agree the method to pay the liability involved.

- The concession is only available with respect to payments made by employers on behalf of their employees up to the end of June 2021.

- Employers paying amounts to settle the employee’s tax liability will not receive a deduction with respect to Corporation Tax as these payments would not be regarded as wholly and exclusively incurred for the purposes of the employer’s trade or profession.

The tax liability arising can be paid by either of the following methods:

- Payment direct to Employee

A payment can be made by the employer directly to the employee with respect to the TWSS tax liability due. The employee must then pay their liability via RevPay.

or

- Amend final payroll submission of 2020

- The last payroll submission of 2020 may be amended by the employer such to include additional 'income tax paid' and 'USC paid' that equals the liability shown on the Preliminary End of Year Statement.

- The employer will then need to pay the additional amounts that are notified via a revised monthly Statement issued by Revenue.

- The employee's Preliminary End of Year Statement will be recalculated subsequently. This will show the additional IT and USC liabilities paid directly by the employer.

What next?

Should you wish to pay your employees’ income tax and USC TWSS liabilities contact your Grant Thornton adviser.

See our Employer Solutions webpage