-

Aviation Advisory

Our dedicated Aviation Advisory team bring best-in-class expertise across modelling, lease management, financial accounting and transaction execution as well as technical services completed by certified engineers.

-

Consulting

Our Consulting team guarantees quick turnarounds, lower partner-to-staff ratio than most and superior results delivered on a range of services.

-

Business Risk Services

Our Business Risk Services team deliver practical and pragmatic solutions that support clients in growing and protecting the inherent value of their businesses.

-

Deal Advisory

Our experienced Deal Advisory team has provided a range of transaction, valuation, deal advisory and restructuring services to clients for the past two decades.

-

Forensic Accounting

Our Forensic and Investigation Services team have targeted solutions to solve difficult challenges - making the difference between finding the truth or being left in the dark.

-

Financial Accounting and Advisory

Our FAAS team designs and implements creative solutions for organisations expanding into new markets or undertaking functional financial transformations.

-

Restructuring

Grant Thornton is Ireland’s leading provider of insolvency and corporate recovery solutions.

-

Risk Advisory

Our Risk Advisory team delivers innovative solutions and strategic insights for the Financial Services sector, addressing disruptive forces, regulatory changes, and emerging trends to enhance risk management and foster competitive advantage.

-

Sustainability Advisory

Our Sustainability Advisory team works with clients to accelerate their sustainability journey through innovative and pragmatic solutions.

-

Asset management Asset management of the futureIn today’s global asset management landscape, there is an almost constant onslaught of change and complexity. To combat such complex change, asset managers need a consolidated approach. Read our publication and find out more about what you can achieve by choosing to work with us.

Asset management Asset management of the futureIn today’s global asset management landscape, there is an almost constant onslaught of change and complexity. To combat such complex change, asset managers need a consolidated approach. Read our publication and find out more about what you can achieve by choosing to work with us. -

Internal Audit Maintaining Compliance with New EU Pension Directive IORP IIOn 28 April 2021, the Irish Government transposed IORP II (Institution for Occupational Retirement Provision), an EU directive on the activities and supervision of pension schemes, into law.

Internal Audit Maintaining Compliance with New EU Pension Directive IORP IIOn 28 April 2021, the Irish Government transposed IORP II (Institution for Occupational Retirement Provision), an EU directive on the activities and supervision of pension schemes, into law. -

Risk, Compliance and Professional Standards FRED 82 – Periodic Updates to FRS 100 – 105The concept of a new suite of standards for the UK and Ireland, aligning with international financial reporting standards, was first conceived in 2002

Risk, Compliance and Professional Standards FRED 82 – Periodic Updates to FRS 100 – 105The concept of a new suite of standards for the UK and Ireland, aligning with international financial reporting standards, was first conceived in 2002 -

Audit and Assurance Auditor transition: how to achieve a smooth changeoverAppointing new auditors may seem like a daunting task that will be disruptive to your business and a drain on the finance function. Nevertheless, there are a multitude of reasons to consider a change, including simply seeking a ‘fresh look’ at the business.

Audit and Assurance Auditor transition: how to achieve a smooth changeoverAppointing new auditors may seem like a daunting task that will be disruptive to your business and a drain on the finance function. Nevertheless, there are a multitude of reasons to consider a change, including simply seeking a ‘fresh look’ at the business.

-

Corporate Tax

Our Corporate Tax team is made up of more than 40 highly experienced senior partners and directors who work directly with a wide range of domestic and international clients; covering Corporation Tax, Company Secretarial, Employer Solutions, Global Mobility and Tax Incentives.

-

Financial Services Tax

The Grant Thornton team is made up of experts who are fully up to date in terms of changing and evolving tax legislation. This is combined with industry expertise and an in-depth knowledge of the evolving financial services regulatory landscape.

-

Indirect Tax Advisory & Compliance

Grant Thornton’s team of indirect tax specialists helps a range of clients across a variety of sectors including pharmaceuticals, financial services, construction and property and food to navigate these complexities.

-

International Tax

We develop close relationships with clients in order to gain a deep understanding of their businesses to ensure they make the right operational decisions. The wrong decision on how a company sells into a new market or establishes a new subsidiary can have major tax implications.

-

Private Client

Grant Thornton’s Private Client Services team can advise you on all areas of financial, pension, investment, succession and inheritance planning. We understand that each individual’s circumstances are different to the next and we tailor our services to suit your specific needs.

One of the key priorities for the 2019 ESMA Supervisory Convergence Work Programme was ensuring supervisory convergence regarding performance fee structures as part of the programme, on 16 July 2019, ESMA published a Consultation Paper (CP) 2 on the proposed draft Guidelines. The consultation closed on 31 October 2019 with the final report issued on the matter on 3 April 2020. The report also contained the guidelines. It was noted in the report that once the Guidelines with the report are translated into the official EU languages and published on the ESMA websites, the National Competent Authorities will have two months to Notify ESMA whether they comply or intend to comply with the guidelines.

ESMA's Guidelines on performance fee in UCITS and certain types of AIFs (the “Guidelines”) were formally published on its website on 5 November 2020.

Scope

The Guidelines apply to Managers and National Competent Authorities. The Guidelines cover the following:

Timelines

The Guidelines will become applicable two months from the date of publication of the Guidelines on ESMA website in all EU official languages, which would mean 5 January 2021 (applicable date).

Where Managers are launching new funds that are in scope of these Guidelines after the applicable date or are introducing a performance fee for the first time to their existing funds that are in scope after the applicable date, the Guidelines would be applicable immediately for those funds.

Managers managing funds that are in scope and which had some sort of performance fee methodology in place have six months from the applicable date to comply with the Guidelines.

Guidelines

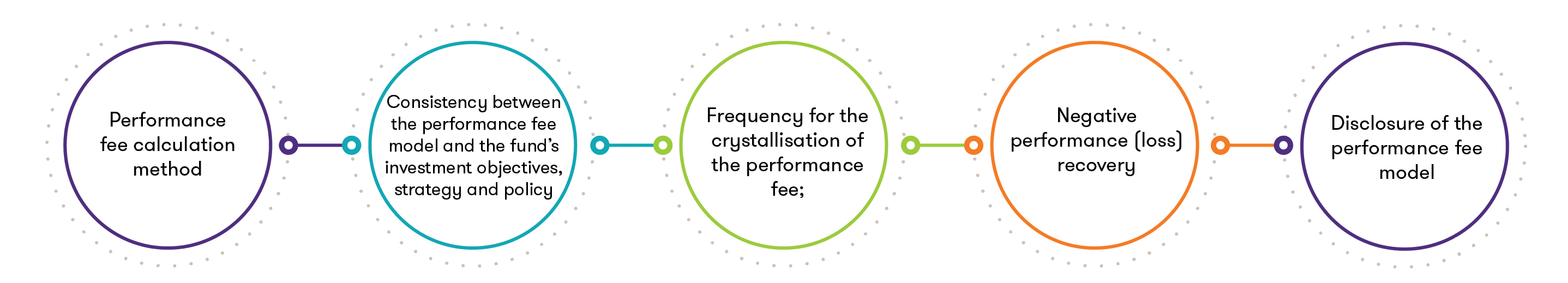

The Guidelines cover the following broad categories:

Key provision of the Guidelines are noted below:

Guideline 1 – Performance fee calculation method

The calculation of a performance fee should be verifiable and not open to the possibility of manipulation.

The performance fee calculation method should include, at least, the following elements:

- the reference indicator to measure the relative performance of the fund (e.g. Index, a HWM, a hurdle rate or a combination of these);

- the crystallisation frequency;

- the performance reference period;

- the performance fee rate;

- the performance fee methodology defining the method for the calculation of the performance fees based on the abovementioned inputs and any other relevant inputs; and

- the computation frequency which should coincide with the calculation frequency of the NAV.

The performance fee calculation method should ensure performance fees are always proportionate to the investment performance. Artificial increases due to new subscriptions should not be taken into account.

Managers need to demonstrate alignment of investors’ interest to the performance fee model and the reasonability of the incentive it receives.

Guideline 2 – Consistency

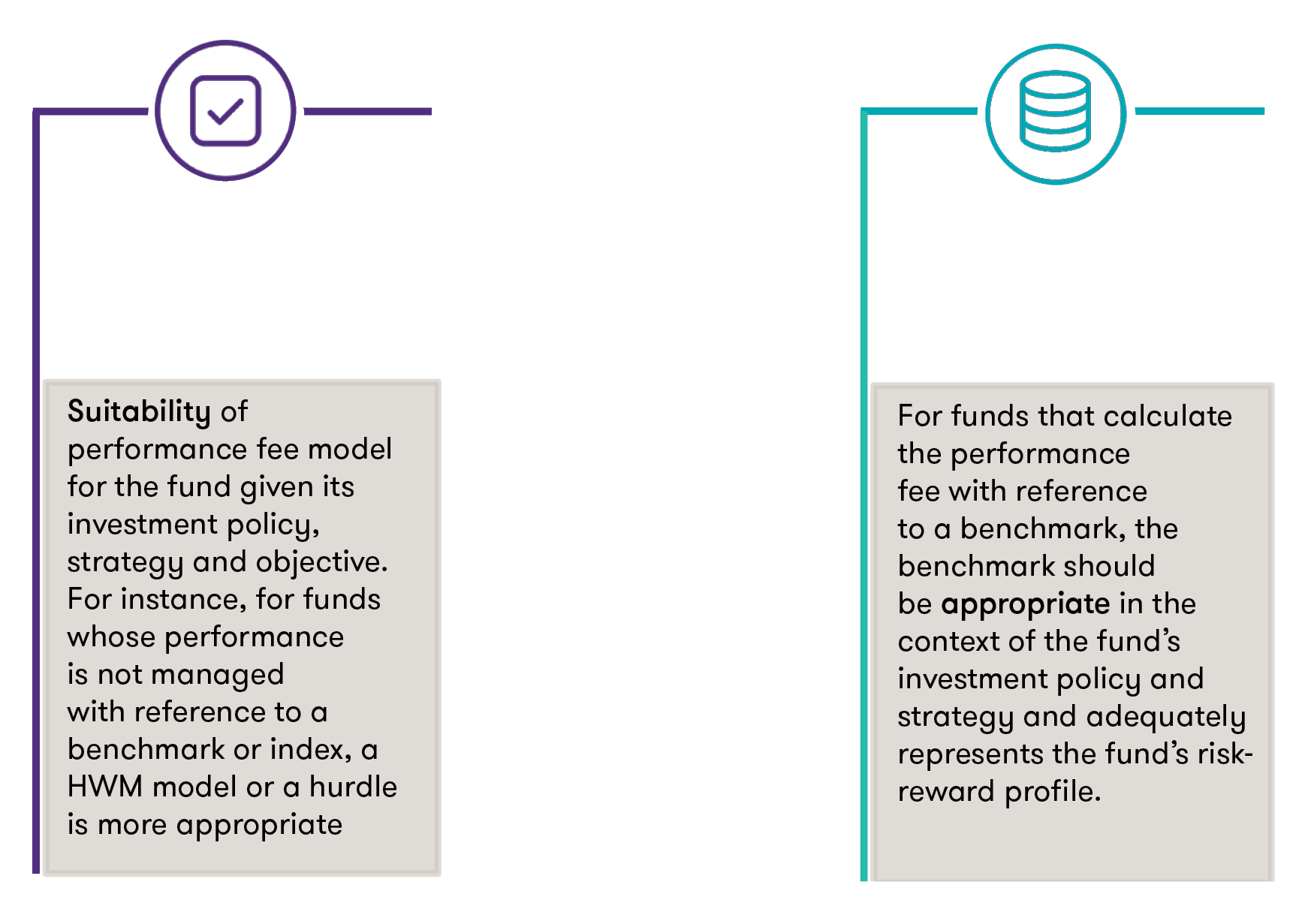

The manager should implement and maintain a process in order to demonstrate and periodically review that the performance fee model is consistent with the fund’s investment objectives, strategy and policy.

When assessing the consistency between the performance fee model and the fund’s investment objectives, strategy and policy, the manager should check:

As a general principle, if a fund is managed in reference to a benchmark index and it employs a performance fee model based on a benchmark index, the two indices should be the same. This includes the case of:

- Performance objective of the fund is linked to a reference benchmark; and

- Holdings of the fund is based on the underlying holdings of a reference benchmark.

In cases where the fund is managed in reference to a benchmark but the fund’s portfolio holdings are not based upon the holdings of the benchmark index, the benchmark used for the portfolio composition should be consistent with the benchmark used for the calculation of the performance fee.

Consistency of the benchmark should be assessed by the manager based on the following parameters:

- expected return;

- investment universe;

- beta exposure to an underlying asset class;

- geographical exposure;

- sector exposure;

- income distribution of the fund;

- liquidity measures;

- duration;

- credit rating category; and

- volatility and/or historical volatility.

If the reference indicator changes during the reference period, the performance of the reference indicator for this period should be calculated by linking the benchmark index that was previously in force until the date of the change and the new reference indicator used afterwards.

Guideline 3 – Frequency for the crystallisation of the performance fee

Performance fee crystallisation and payment should ensure alignment of managers’ and investors’ interests and fair treatment of investors.

The crystallisation frequency should not be more than once a year. This however will not be applicable where the fund employs a high water-mark model or a high-on-high model where the performance reference period is equal to the whole life of the fund.

The crystallisation date should be the same for all share classes of a fund that levies a performance fee.

Guideline 4 – Negative performance (loss) recovery

A performance fee should only be payable for positive performance during the reference period. Any underperformance or loss previously incurred during the performance reference period should be recovered before a performance fee becomes payable.

In cases where the fund has outperformed the reference benchmark index but had a negative performance, a performance fee could be charged as long as a prominent warning to the investor is provided.

Performance fee models should be designed to ensure that the manager is not incentivised to take excessive risks and also should ensure that the time horizon for Manager’s incentive remuneration should be as far as possible, consistent with the recommended investor’s holding period.

Performance fee models based on a benchmark index, should be ensure that any underperformance of the fund compared to the benchmark is clawed back before any performance fee becomes payable. To this purpose, the length of the performance reference period, if this is shorter than the whole life of the fund, should be set equal to at least 5 years.

For HWM models, a performance fee should be payable only where, during the reference period, the new HWM exceeds the last HWM. In case the performance reference period is shorter than the whole life of the fund, the performance reference period should be set equal to at least five years on a rolling basis. In this case, performance fee may only be claimed if the outperformance exceeds any underperformances during the previous five years and performance fees should not crystallise more than once a year.

Guideline 5 - Disclosure of the performance fee model

The prospectus and any relevant information documents (including marketing materials), should clearly set out all information necessary to enable investors to understand properly the performance fee model and the computation methodology. These documents should clearly note the performance fee calculation method, with specific reference to parameters and the crystallisation and payment.

The prospectus should indicate all main elements of the performance fee calculation as noted in Guideline 1. It should also include concrete examples of the performance fee calculation providing investors with a better understanding of the performance fee model especially where the performance fee model allows for performance fees to be charged even in case of negative performance.

For performance fee methodologies that compute performance fee with reference to a different but consistent benchmark (see Guideline 2), the choice of benchmark should be explained in the prospectus.

The KIID should clearly set out all information necessary to explain the existence of the performance fee, the basis on which the fee is charged and when the fee applies.

KIID should clearly note a prominent warning for cases where in times of negative performance, performance fee may be payable if the fund outperforms the reference benchmark.

Both KIID and prospectus should clearly identify the benchmark index used in the calculation of performance fee if applicable and show past performance against it.

The annual and half-yearly reports and any other ex-post information should indicate, for each applicable share class the following:

- the actual amount of performance fees charged; and

- the percentage of the fees based on the share class NAV.