Sign up for expert insights, industry trends, and key updates—delivered straight to you.

Environment

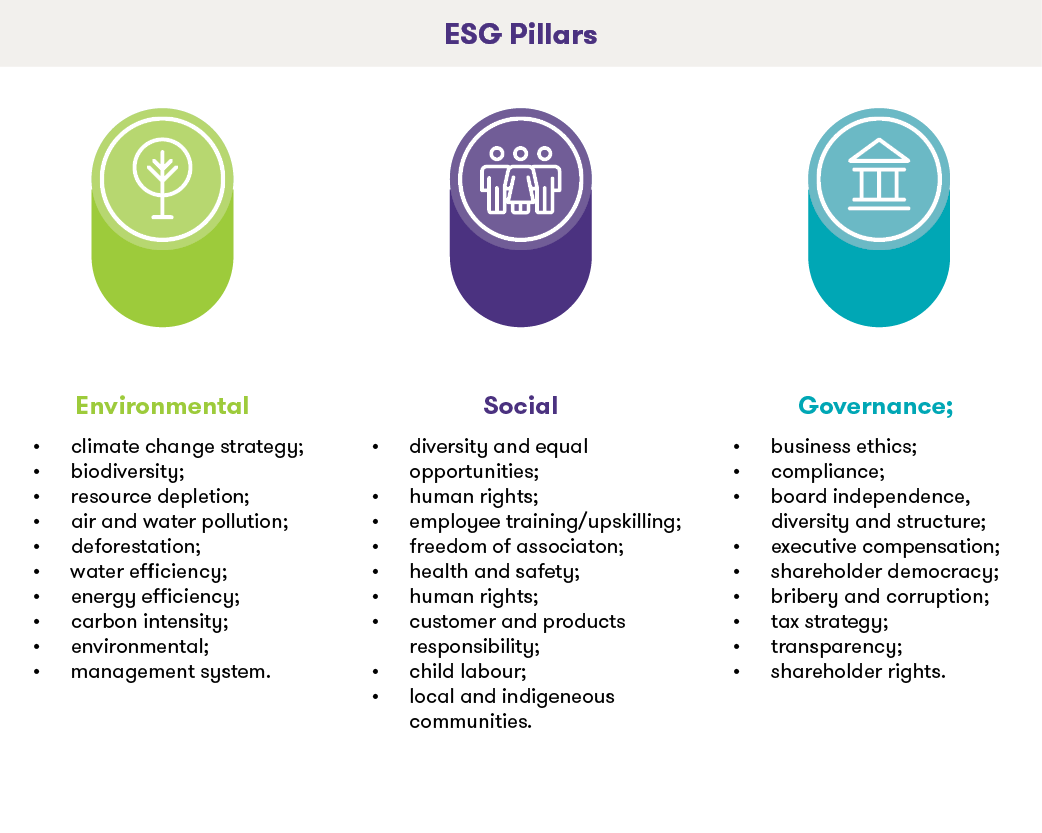

While there has been much discussion of sustainability and ESG (Environmental, Social, Governance) factors in relation to the banking sector in recent times, the reality is that much if not all regulatory instruments to date have focused on a subsection of ‘E’; climate change. Several factors have contributed to this including its actual and predicted impacts, political and social momentum, as well as a growing body of research that facilitates quantification of the associated risks.

Examples of this initial focus

- The European Banking Authority (EBA) who acknowledged its initial focus is on climate change in its report on ‘Management and Supervision of ESG Risks for Credit Institutions and Investment Firms’ in June 2021.

- The 13 supervisory expectations outlined by the EBA in their ‘Guide on climate related and environmental risks’ published in November 2020, highlighted the risks and opportunities resulting from the climate crisis in particular.

- Though the European Union (EU) Taxonomy, a classification of environmentally sustainable investments, had initially outlined six environmental objectives, it has prioritised the disclosures relating to (i) climate change adaption and (ii) climate change mitigation over the other four objectives.

- Other examples of how climate risk was introduced in the banking sector include updated Pillar III disclosures and the European Central Bank (ECB) Climate Stress Test, both of which require a number of key data points (e.g. Scope 1, 2, and 3 emissions, financed emissions and collateral energy efficiency). The climate stress test is one of the first initiatives addressing quantification of climate risk. There is an expectation that climate risk will be introduced into Pillar II capital requirements in time and will have a direct impact on banks’ capital adequacy.

Expanding the environmental focus beyond climate change

In 2021, the Taskforce for Nature-related Financial Disclosures (TNFD) was formally launched in 2021. It aims to build on the success of the Task Force for Climate Related Financial Disclosures (TCFD) which is perhaps one of the most influential initiatives in raising the profile of climate change within the financial sector. Backed by both the United Nations Environment Programme for Finance Initiative (UNEP FI) and the Intergovernmental Panel on

Climate Change (IPCC), and created by the Financial Stability Board, it published its recommendations in 2017. While the recommendations were initially voluntary, increasingly they have been used as the basis for regulations and between compliance and investor pressure seem set to become the norm rather than the exception.

In March of this year, the TNFD released a beta version of their first report. Similar to TCFD, it includes guidance on nature related risks and opportunities, supports to assist organisations in conducting assessments, and disclosure recommendations. Supporters of this initiative include UNEP FI and the G20 intergovernmental forum. In time it could be expected to make a similar impact to TCFD.

The publication coincides with increased focus on biodiversity from the EU, including;

- Plans later this year for the European Commission to develop a report on the potential financial risks associated with biodiversity loss and ecosystem degradation and explore the possible sustainable finance policy changes needed.

- In line with the EU Taxonomy Regulation, the need for in-scope institutions to report on the protection and restoration of biodiversity and ecosystems is expected from 2023.

[1]https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Reports/2021/1015656/EBA%20Report%20on%20ESG%20risks%20management%20and%20supervision.pdf

[2]https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202011finalguideonclimate-relatedandenvironmentalrisks~58213f6564.en.pdf

Social

As recognised by the ECB, the links between social performance and financial impacts are more difficult to quantify than climate change. The approach to date, reflected in elements of the EU Taxonomy, Sustainable Finance Disclosure Regulation (SFDR) and referenced by the ECB, is the concept of adhering to minimum safeguards or established norms. This refers to the commitment by companies to comply with expectations laid out in established international frameworks and voluntary agreements.

These include:

- The International Labour Organization (ILO Conventions and Declaration of Fundamental Principles and Rights at Work

- The UN Guiding Principles on Business and Human Rights

- The OECD Guidelines for Multinational Enterprises

- The OECD Due Diligence Guidance for Responsible Business Conduct

At a basic level, this will simply be a binary option – yes / no. While still a useful threshold, the lack of consistent granular data makes it more difficult to quantify the risks associated with poor social performance. Companies subject to Non-Financial Reporting Directive (NFRD) are also obliged to publish information related to board diversity, respect for human rights, social matters and treatment of employees but this only applies to large companies and institutions (i.e. 500 or more employees).

The EU has recognised the need for further data and disclosures in this area, and is taking steps to address and enhance disclosures in this areas, including:

- The development of a social taxonomy which looks to ensure investors and companies make best-practice decisions with regards to social values. This has become even more relevant with the rise in issuance of social bonds. Though similar to the environmental taxonomy in structure, the current draft of the framework focuses on the three key stakeholder groups: workers, consumers and communities, with the objective to:

The European Sustainability Reporting Standards are currently under development as part of the CSRD process. They include proposals to require firms to publicly disclose, amongst other requirements,

- detailed descriptions of the risks and opportunities of all stakeholders in a firm’s value chain, and also information related to:

- social matters and treatment of employees

- respect for human rights

- anti-corruption and bribery

- diversity on company boards (in terms of age, gender, educational and professional background).

- Updated Pillar 3 disclosure templates now include both social and governance qualitative tables to be populated

Governance

Unlike environmental and social considerations, governance is perhaps the most established pillar that falls under ESG. Regulation has existed for a number of years promoting good governance practices including those in relation to compliance, board independence, ethics, bribery and corruption. With the addition of a sustainability lens, the field has widened to include elements like diversity and inclusion, tax strategy and transparency. A number of sustainability related regulatory developments will impact the governance of institutions. These include:

- ECB expectations, which specifically address the need to incorporate of sustainability into strategy, executive ownership and accountability for delivery of that strategy, and disclosures on how remuneration policy is linked to sustainability strategy.

- The Sustainable Finance Disclosure Regulation also encourages disclosure information relating to the incorporation of sustainability into investment policies, and how remuneration is linked to it.

- The European Commission has also adopted a proposal for a Directive on Corporate Sustainability Due Diligence (CSDD), this proposal aims to foster sustainability in corporate governance and value chains. The proposed Directive will require companies to identify and mitigate adverse environmental and human rights across their own operations, subsidiaries and supply chain. This Directive is closely related to the CSRD and the EU Taxonomy’s minimum safeguards, and represents a significant step towards embedding sustainability into corporate governance frameworks.

Key Considerations

As has been clear for some time, the focus on climate change represents just the start of the sustainability regulatory journey. Europe is looking to broaden the scope of regulation to include further ESG considerations. For financial institutions, this points to the need to upskill in topics such as biodiversity, and social performance, as well as developing flexible data systems to capture and interrogate new data sets as they become available.

For wider industry, the focus should be particularly on monitoring developments around the proposed European Sustainability Standards and considering the skill sets and infrastructure that will be required to comply.

How Grant Thornton can help

Grant Thornton’s Financial Services Risk, Consulting and Advisory teams are comprised of dedicated experts who are experienced in supporting banks and investment firms with a variety of regulatory challenges.

Our team understands that regulation continues to drive the strategic agenda for banks. Working together with our dedicated Sustainability Team, we believe our skillsets combine the best of scientific knowledge with real world financial and regulatory experience to deliver practical, actionable solutions. We specialise in assisting clients across the financial services sector in navigating through the complex maze sustainability related regulation and support clients to identify regulatory obligations and work towards full compliance balanced with your business needs.