-

Aviation Advisory

Our dedicated Aviation Advisory team bring best-in-class expertise across modelling, lease management, financial accounting and transaction execution as well as technical services completed by certified engineers.

-

Consulting

Our Consulting team guarantees quick turnarounds, lower partner-to-staff ratio than most and superior results delivered on a range of services.

-

Business Risk Services

Our Business Risk Services team deliver practical and pragmatic solutions that support clients in growing and protecting the inherent value of their businesses.

-

Deal Advisory

Our experienced Deal Advisory team has provided a range of transaction, valuation, deal advisory and restructuring services to clients for the past two decades.

-

Forensic Accounting

Our Forensic and Investigation Services team have targeted solutions to solve difficult challenges - making the difference between finding the truth or being left in the dark.

-

Financial Accounting and Advisory

Our FAAS team designs and implements creative solutions for organisations expanding into new markets or undertaking functional financial transformations.

-

Restructuring

Grant Thornton is Ireland’s leading provider of insolvency and corporate recovery solutions.

-

Risk Advisory

Our Risk Advisory team delivers innovative solutions and strategic insights for the Financial Services sector, addressing disruptive forces, regulatory changes, and emerging trends to enhance risk management and foster competitive advantage.

-

Sustainability Advisory

Our Sustainability Advisory team works with clients to accelerate their sustainability journey through innovative and pragmatic solutions.

-

Asset management Asset management of the futureIn today’s global asset management landscape, there is an almost constant onslaught of change and complexity. To combat such complex change, asset managers need a consolidated approach. Read our publication and find out more about what you can achieve by choosing to work with us.

Asset management Asset management of the futureIn today’s global asset management landscape, there is an almost constant onslaught of change and complexity. To combat such complex change, asset managers need a consolidated approach. Read our publication and find out more about what you can achieve by choosing to work with us. -

Internal Audit Maintaining Compliance with New EU Pension Directive IORP IIOn 28 April 2021, the Irish Government transposed IORP II (Institution for Occupational Retirement Provision), an EU directive on the activities and supervision of pension schemes, into law.

Internal Audit Maintaining Compliance with New EU Pension Directive IORP IIOn 28 April 2021, the Irish Government transposed IORP II (Institution for Occupational Retirement Provision), an EU directive on the activities and supervision of pension schemes, into law. -

Risk, Compliance and Professional Standards FRED 82 – Periodic Updates to FRS 100 – 105The concept of a new suite of standards for the UK and Ireland, aligning with international financial reporting standards, was first conceived in 2002

Risk, Compliance and Professional Standards FRED 82 – Periodic Updates to FRS 100 – 105The concept of a new suite of standards for the UK and Ireland, aligning with international financial reporting standards, was first conceived in 2002 -

Audit and Assurance Auditor transition: how to achieve a smooth changeoverAppointing new auditors may seem like a daunting task that will be disruptive to your business and a drain on the finance function. Nevertheless, there are a multitude of reasons to consider a change, including simply seeking a ‘fresh look’ at the business.

Audit and Assurance Auditor transition: how to achieve a smooth changeoverAppointing new auditors may seem like a daunting task that will be disruptive to your business and a drain on the finance function. Nevertheless, there are a multitude of reasons to consider a change, including simply seeking a ‘fresh look’ at the business.

-

Corporate Tax

Our Corporate Tax team is made up of more than 40 highly experienced senior partners and directors who work directly with a wide range of domestic and international clients; covering Corporation Tax, Company Secretarial, Employer Solutions, Global Mobility and Tax Incentives.

-

Financial Services Tax

The Grant Thornton team is made up of experts who are fully up to date in terms of changing and evolving tax legislation. This is combined with industry expertise and an in-depth knowledge of the evolving financial services regulatory landscape.

-

Indirect Tax Advisory & Compliance

Grant Thornton’s team of indirect tax specialists helps a range of clients across a variety of sectors including pharmaceuticals, financial services, construction and property and food to navigate these complexities.

-

International Tax

We develop close relationships with clients in order to gain a deep understanding of their businesses to ensure they make the right operational decisions. The wrong decision on how a company sells into a new market or establishes a new subsidiary can have major tax implications.

-

Private Client

Grant Thornton’s Private Client Services team can advise you on all areas of financial, pension, investment, succession and inheritance planning. We understand that each individual’s circumstances are different to the next and we tailor our services to suit your specific needs.

Receive the latest insights, news and more direct to your inbox.

The draft bill published in July 2021 contained four main parts, and particular focus has been given to the Senior Executive Accountability Regime (“SEAR”). SEAR is novel, has significant implications for Regulated Financial Services Providers (“RFSPs”) and their senior management.

While various international jurisdictions have implemented accountability regimes, the United Kingdom’s Prudential Regulatory Authority (“PRA”) and Australia’s Australian Prudential Regulatory Authority (“APRA”) were the first two bodies to evaluate their implementation of such regimes.

Learnings from the UK and Australian Accountability Regimes

The UK Senior Managers and Certification Regime (“SMCR”)

In the PRA’s evaluation of SMCR post implementation, 140 in-scope firms as well as a number of PRA supervisors assessed the impact the regime had on firms’ cultures and behaviours. Overall, the PRA found that SMCR had the desired impact of improving firms’ cultures and behaviours, while 83% of Executives surveyed also believed that SMCR had changed working practices for the better.

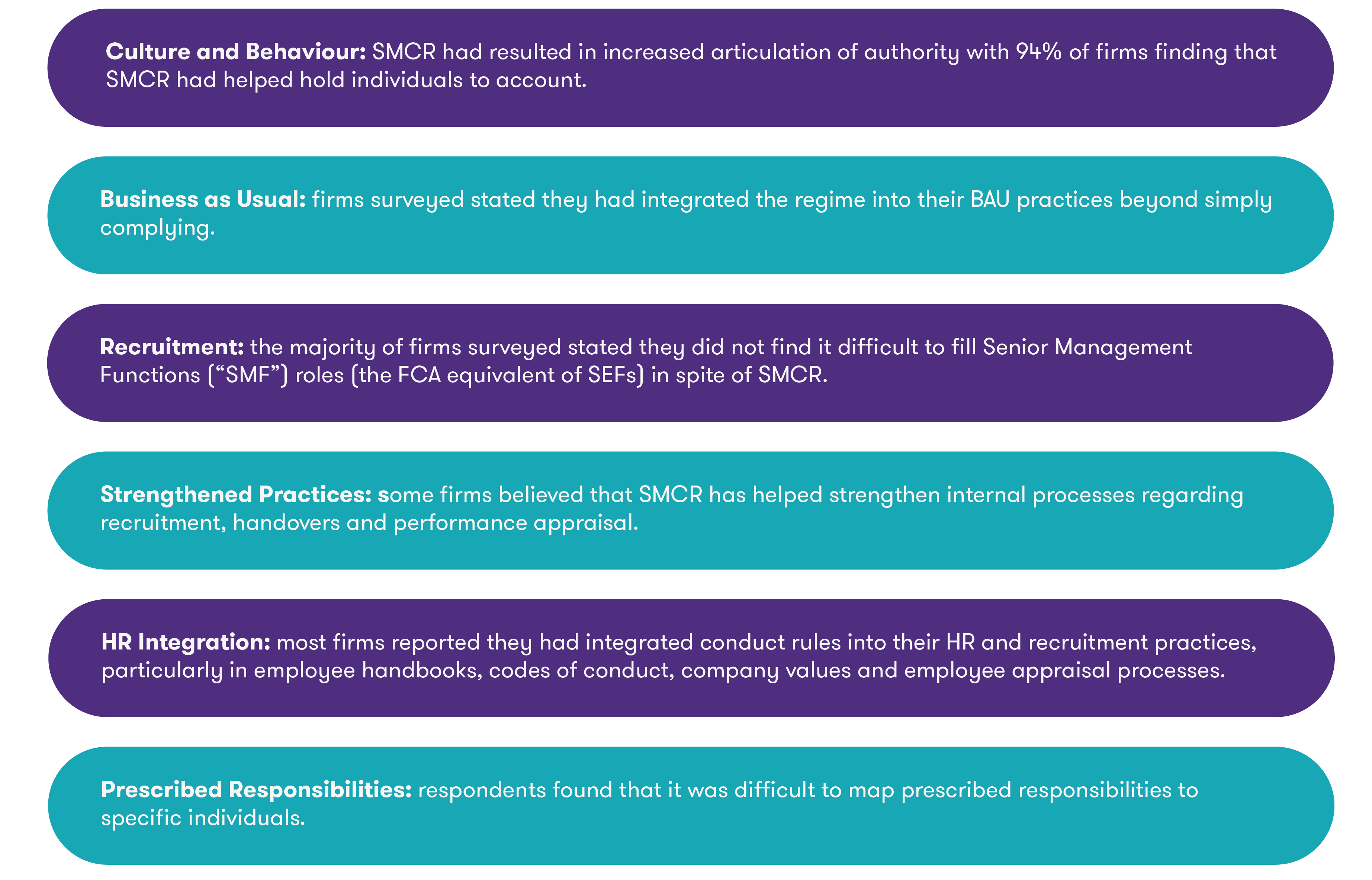

In addition to improved firm culture and working practices, SMCR had the following impacts:

The Australia Banking Executive Accountability Regime (“BEAR”)

Evaluations conducted by the APRA, as well as research conducted by two professors from Macquarie University’s Business School found that the BEAR had positive impacts on accountability in Australian banking.

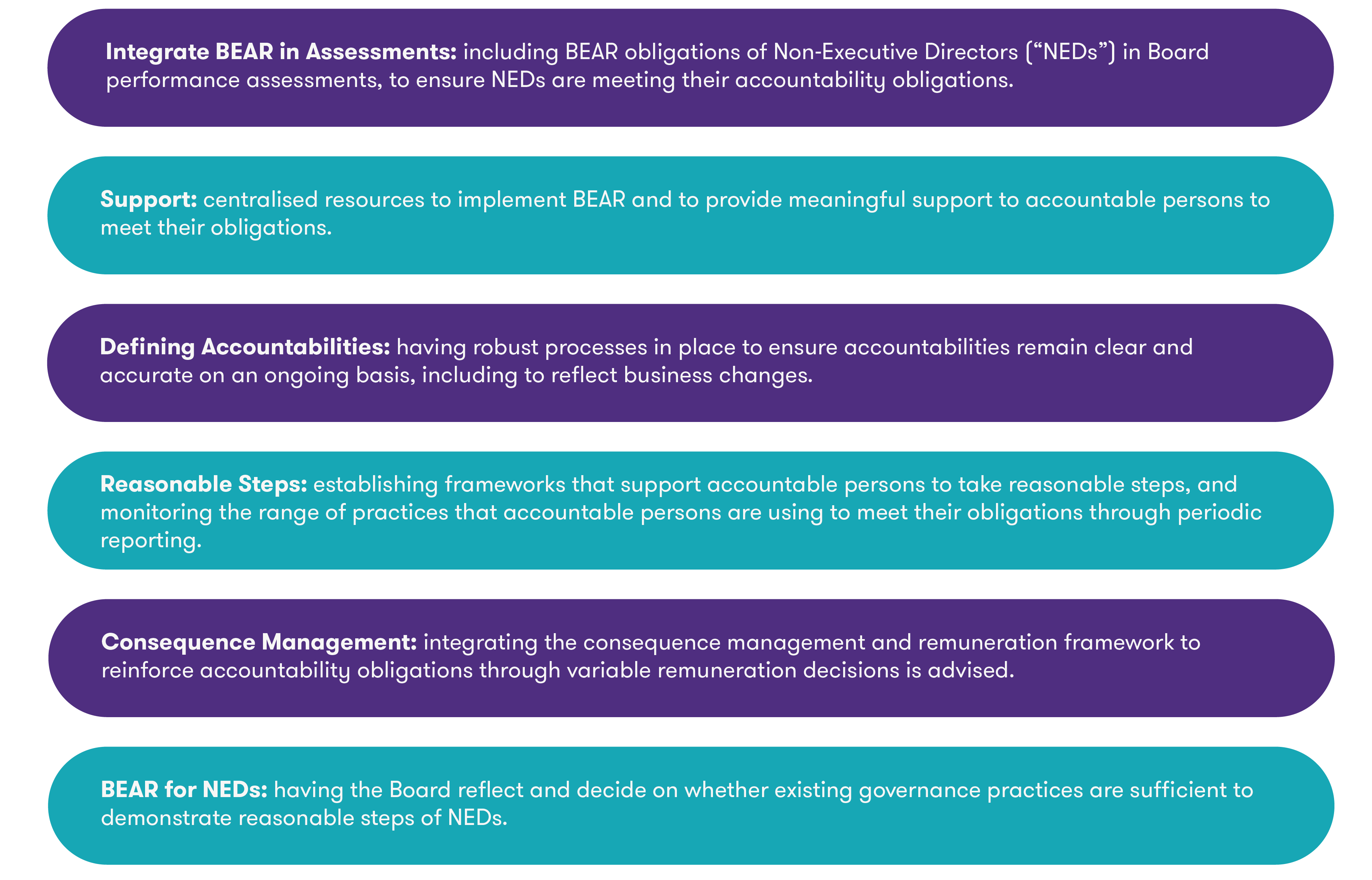

The research conducted focused on three of Australia’s largest banks: Australia and New Zealand Banking Group Limited (ANZ), Commonwealth Bank of Australia (CBA) and National Australia Bank Limited (NAB). While in the UK the PRA focused on the impacts that SMCR had post implementation, the APRA focused on the considerations for firms in the implementation of BEAR. The key findings from both the APRA and Macquarie’s evaluations included the following recommendations to help firms:

Lessons for Irish RFSPs

Given the lessons learned from both the UK and Australian regimes, we can see that the Senior Executive Accountability Regime is likely to have a major impact on improving organisational culture and increasing levels of senior executive accountability. Judging from the impacts of SMCR and BEAR, it is also possible that firms may not experience any difficulty recruiting for SEF roles, while their internal practices may also be improved by the introduction of SEAR. Looking specifically at BEAR, it is advisable that RFSPs establish frameworks that support SEFs taking Reasonable Steps, that centralised resources are introduced to implement the regime and that each SEF’s compliance with SEAR is included in their periodic performance assessments.

Conclusion

Our Services

Grant Thornton Ireland are well positioned to help your firm work through the introduction of IAF and SEAR. From bespoke advice to large scale implementation projects, our subject matter experts in Conduct Risk are here to help your organisation with all things IAF-related.