Introduction

Anti-Money Laundering legislation requires each EU Member State to establish a Central Register of Beneficial Ownership of Trusts (“CRBOT”).

The CRBOT will contain details of relevant trusts and their beneficial owners. Trustees must submit these details to the Irish Revenue, who will manage the CRBOT.

For trusts that were established on or before 23 April 2021, the registration deadline is 23 October 2021. Trusts created after 23 April 2021 must be filed within 6 months of their creation.

The following shall have the right to inspect the Trust Register: -

- An Garda Síochána

- Financial Intelligence Unit (FIU) Ireland

- Revenue Commissioners

- Criminal Assets Bureau

- Competent authorities engaged in the prevention, detection or investigation of possible money laundering or terrorist financing.

- A designated person as defined by Section 25 of the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (in certain circumstances).

Trusts Required to Register and Certain Exemptions

Relevant trusts must submit information to the CRBOT when:

- the trustees are resident in the State, or;

- the trust is administered in the State

A relevant trust is an express trust established by deed or other declaration in writing.

Sports Clubs

Relevant trusts created to hold the assets of an Approved Sports Body under Section 235 of the TCA 1997 must register with the Central Register of Beneficial Ownership of Trusts (CRBOT).

Charities

Relevant trusts that are charitable trusts under Section 2 of the Charities Act 2009 must register with the CRBOT.

Estates

If you have made a will that provides that some of your assets will be held in trust after your death you do not need to register with the CRBOT until the trust comes into effect. The trust only comes into being on your death.

Excluded Arrangements are exempt from registering with the CRBOT

- approved occupational pension schemes

- approved retirement funds

- approved profit-sharing schemes or employee share ownership trusts

- trusts for restricted share

- the Haemophilia HIV Trust

- unit trusts

Multiple Member States

Where a trust is administered in more than one EU Member State (or where two or more of its trustees reside in different Member States) specific rules apply so that a duplication of filings need not occur provided evidence of filing in the other Member State can be provided. In this instance the trustee must acquire a certificate (which must be made available for inspection) from the Registrar in another MS where a relevant trust:

- is administered in more than one MS; or

- two or more of the trustees reside in different MS; and

- the trustee has filed on the Central Register in another MS; and

- the information is the same as what is required to be filed on the CRBOT.

Non-Residents

Trusts where none of the trustees are resident in the EU and the trust is not administered in the EU must register with the CRBOT if:

- A trustee enters a business relationship in the State on behalf of the trust; or

- A trustee acquires land or other real property in the State in the name of the trust.

This will apply as long as the business relationship exists or the land or property continues to be held by a trustee.

If the trustees are not resident in the EU but have business relationships or property in more than one MS, then

The trustee must acquire a certificate from the Registrar in another MS where:

- a trustee enters a business relationship in Ireland on behalf of the trust; or

- a trustee acquires land or other real property in Ireland in the name of the trust; and

- the trustee has filed the information on the Central Register in another MS; and

- the information is the same as what is required to be filed on the CRBOT.

What information must be submitted on the CRBOT?

Trustees must submit information in relation to each beneficial owner of the trust.

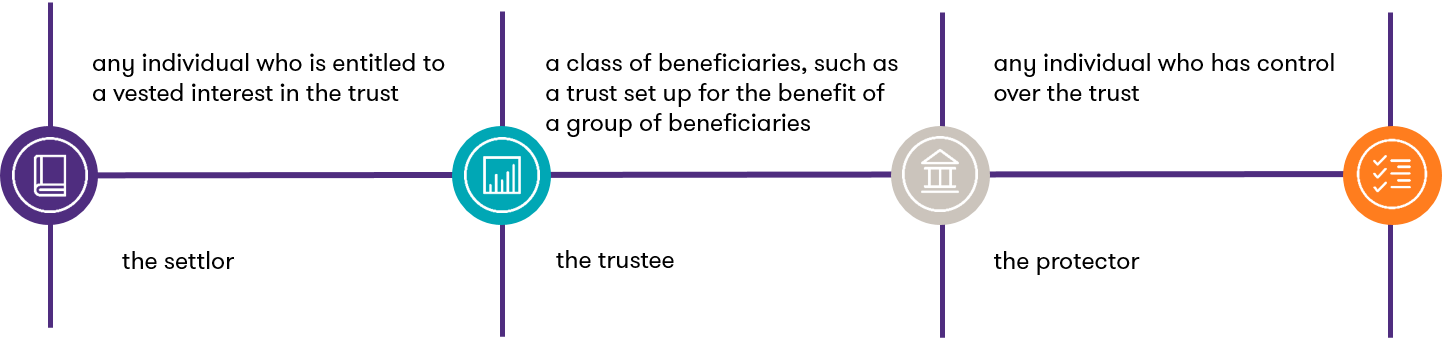

A beneficial owner is any one of the following:

Information to be filed when the beneficial owner is an individual:

If the individual does not have a PPSN they must provide and upload proof of one of the following:

- foreign tax registration number

- passport number; or

- national identity number.

Information to be filed when the beneficial owner is a legal entity

How to Register for the CRBOT

Trustees (or their agents, advisors, or employees) can register through the ‘Trust Register’ portal on Revenue Online Service (ROS).

For more information, contact our related experts below.