The current NFRD regime

The Non-Financial Reporting Directive (Directive 2014/95/EU) (‘NFRD’) is currently in place, and is the forerunner to the proposed Corporate Sustainability Reporting Directive. It was adopted in 2014 with the aim of encouraging companies to disclose information related to environmental, social and governance considerations. Subsequent guidelines were published in 2017 and 2019, including information on climate related disclosures. Compliant entities, i.e. those who adopted the reporting requirements laid out in the NFRD, were required to report in accordance with the NFRD provisions for the first time in 2018.

The NFRD applies to large EU “public interest” entities (i.e. listed companies, banks/credit institutions, insurance companies and other entities designated by Member States). Under the NFRD, to qualify as ‘large’ entities must have the following:

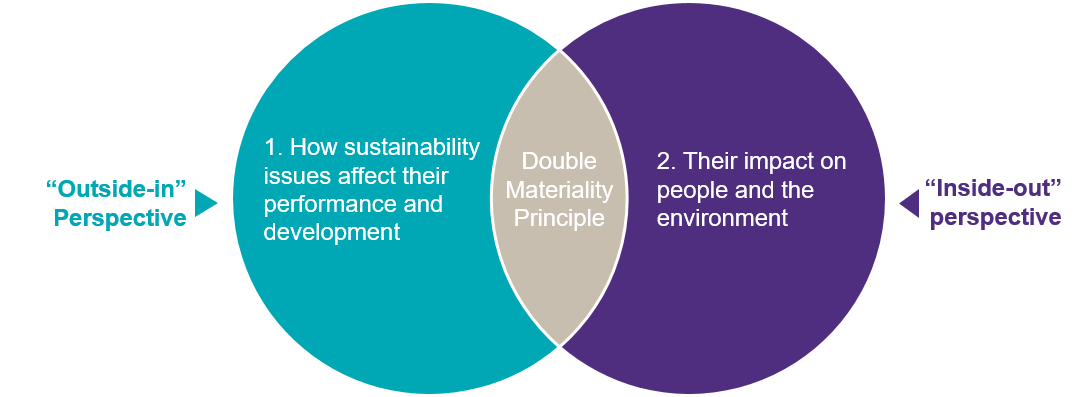

Under the NFRD, companies are required to report on the following two aspects, which are often known as the “double materiality” principle of non-financial reporting.

The NFRD applies on a “comply or explain” basis, which gives companies the ability to not adopt the policies and not carry out the due-diligence laid out in the NFRD directive. The “comply or explain” system ensures that if a company does not apply a policy, it will be disclosed publically.

The Corporate Sustainability Reporting Directive Proposal

The European Commission’s proposal for a Corporate Sustainable Reporting Directive (CSRD) (2021/0104) was published on April 21st 2021, as part of an updated sustainable finance strategy. The CSRD is set to entirely replace the NFRD, and amend the provisions of the Accounting Directive, the “Transparency Directive” (2004/109/EC), and the “Audit Directive” and “Audit Regulation” (2006/43/EC and 537/2014). Around 50,000 undertakings will be covered under the CSRD (compared to the 11,700 that are now subject to the NFRD).

Stakeholder concerns regarding information published by in-scope companies (i.e. ‘large’ public interest entities who opted to adopt the NFRD policies), as highlighted in the NFRD consultation paper, are addressed in the CSRD. It is viewed as the first step in bringing sustainable reporting on par with financial reporting over time. As part of the CSRD, more than 50,000 EU entities will be required to publish “sustainable information” as part of their annual reports.

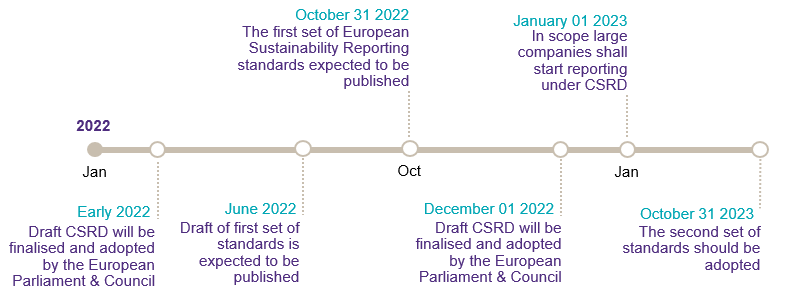

The CSRD proposal has been submitted to the European Parliament and Council. Once approved and adopted by the European Parliament and the Council, Member States will be required to implement the provisions of the CSRD by December 1, 2022. The CSRD’s sustainability reporting obligations will apply to companies’ annual reports for the financial years starting on/after January 1, 2023.

- The CSRD will not apply the concept of “public interest” entities. Instead, the new provisions will apply to:

- An entity will be considered “large” if it exceeds at least two of the following on its balance sheet:

- The “sustainability information” that will be required to be disclosed will concern at a minimum the following four items from a “double materiality” perspective:

CSRD Reporting Standards

While preparing the CSRD proposal, the Commission considered the recommendations established by the European Financial Reporting Advisory Group (EFRAG) to investigate the possibility of developing EU-wide sustainability reporting standards. Following publication of the proposal, this same group will now develop a set of European Sustainability Standards (ESS) against which in scope companies and institutions would report.

CSRD Audit Requirements

Under the NFRD no audit is required with respect to the contents of the sustainability-related information submitted by companies nor the methodology used to evaluate sustainability risks and sustainability impacts. The NFRD offers an option to participating in-scope firms to seek independent verification by an assurance services provider, but is not required to be a full-service audit firm.

The CSRD is set to introduce a more complete approach to audit or assurance requirements on non-financial statements. There will be an obligation on the auditor or audit firm to express an opinion about the compliance of the sustainability reporting with Union requirements based on a limited assurance engagement. This opinion must cover the compliance of the sustainability reporting with regard to standards and the methodology used by the reporting entity to identify the information.

Securing audit quality, independence and competence shall be a key priority when carrying-out the statutory audit and the assurance of sustainability reporting.

CSRD Publication and Submissions

The CSRD requires that all information is published as part of companies’ management reports, and disclosed in a digital, machine-readable format. This compares to the NFRD, where companies were permitted to disclose sustainability information in a separate document.

Compliant in-scope company’s administrative, management and supervisory bodies will have collective responsibility for ensuring the sustainability information reported is in line with the requirements set out in the CSRD.

CSRD Timeline

How Companies Can Prepare

While the first draft of European sustainability reporting standards are not expected to be published until June 2022, the statement of cooperation between EFRAG and the Global Reporting Initiative (GRI) highlights the influential role existing voluntary standards and frameworks (including TCFD) will have in shaping their development. By reviewing and developing processes to report against key voluntary initiatives now, companies will be in a better position to comply with CSRD requirements as they become live.

Why Grant Thornton

Grant Thornton’s Financial Services Risk, Consulting and Advisory teams are comprised of dedicated experts who are experienced in supporting companies with these regulatory challenges outlined in the Corporate Sustainability Reporting Directive.

In particular, our industry-leading Prudential Risk team understands that regulation continues to drive the strategic agenda for financial and non-financial institutions Working together with our sustainability specialists, we believe our skillsets combine the best of scientific knowledge with real world experience to deliver practical, actionable solutions. We specialise in assisting clients across the financial services sector in navigating through the maze of regulation and support clients to identify regulatory obligations and work towards full compliance balanced with your business needs.