Introduction

The European Central Bank (ECB) is beginning to provide tangible guidance to financial institutions as to how climate change and environmental risks should be managed within an organisation. In late 2020 the ECB published its final and amended guide on climate-related and environmental risks, following a public consultation. The guide explains how the ECB expects banks to prudently manage and transparently disclose such risks under current prudential rules.

The expectations set out in the guide are to be read in conjunction with, and are not intended to substitute or supersede, any applicable law. The guidance is applicable to those Significant Institutions (SI) directly supervised by the ECB (i.e. those c. 130 largest banking groups in the EU). National Competent Authorities are expected to apply the guidance to Less Significant Institutions (LSI) in a manner that is proportionate to the nature, scale and complexity of the activities of the institution concerned. The guide was applicable as of the date of publication, November 27th 2020.

What are the Risks?

The guide defines the two risk types to be considered as:

- Physical risk refers to the financial impact of a changing climate, including more frequent extreme weather events and gradual changes in climate, as well as of environmental degradation, such as air, water and land pollution, water stress, biodiversity loss and deforestation; and,

- Transition risk refers to an institution’s financial loss that can result, directly or indirectly, from the process of adjustment towards a lower-carbon and more environmentally sustainable economy.

How should Firms address them?

Regulators expect institutions to address the two sub-types of climate change and environmental risk in the following ways.

Business Model and Strategy

Institutions are expected to understand and illustrate that understanding of the impact of climate-related and environmental risks on the business environment in which they operate, in the short, medium and long term, in order to be able to make informed strategic and business decisions.

Governance and Risk Appetite

The management body is expected to consider climate-related and environmental risks when developing the institution’s overall business strategy, business objectives and risk management framework and to exercise effective oversight of climate-related and environmental risks. Institutions are expected to explicitly include climate-related and environmental risks in their risk appetite framework and assign responsibility for the management of such risks within the organisational structure in accordance with the three lines of defence model.

For the purposes of internal reporting, institutions are expected to report aggregated risk data that reflect their exposures to climate-related and environmental risks with a view to enabling the management body and relevant sub-committees to make informed decisions.

Risk Management

Institutions are expected to incorporate climate-related and environmental risks as drivers of existing risk categories into their risk management framework, with a view to managing, monitoring and mitigating these over a sufficiently long-term horizon, and to review their arrangements on a regular basis. Institutions are expected to identify and quantify these risks within their overall process of ensuring capital adequacy.

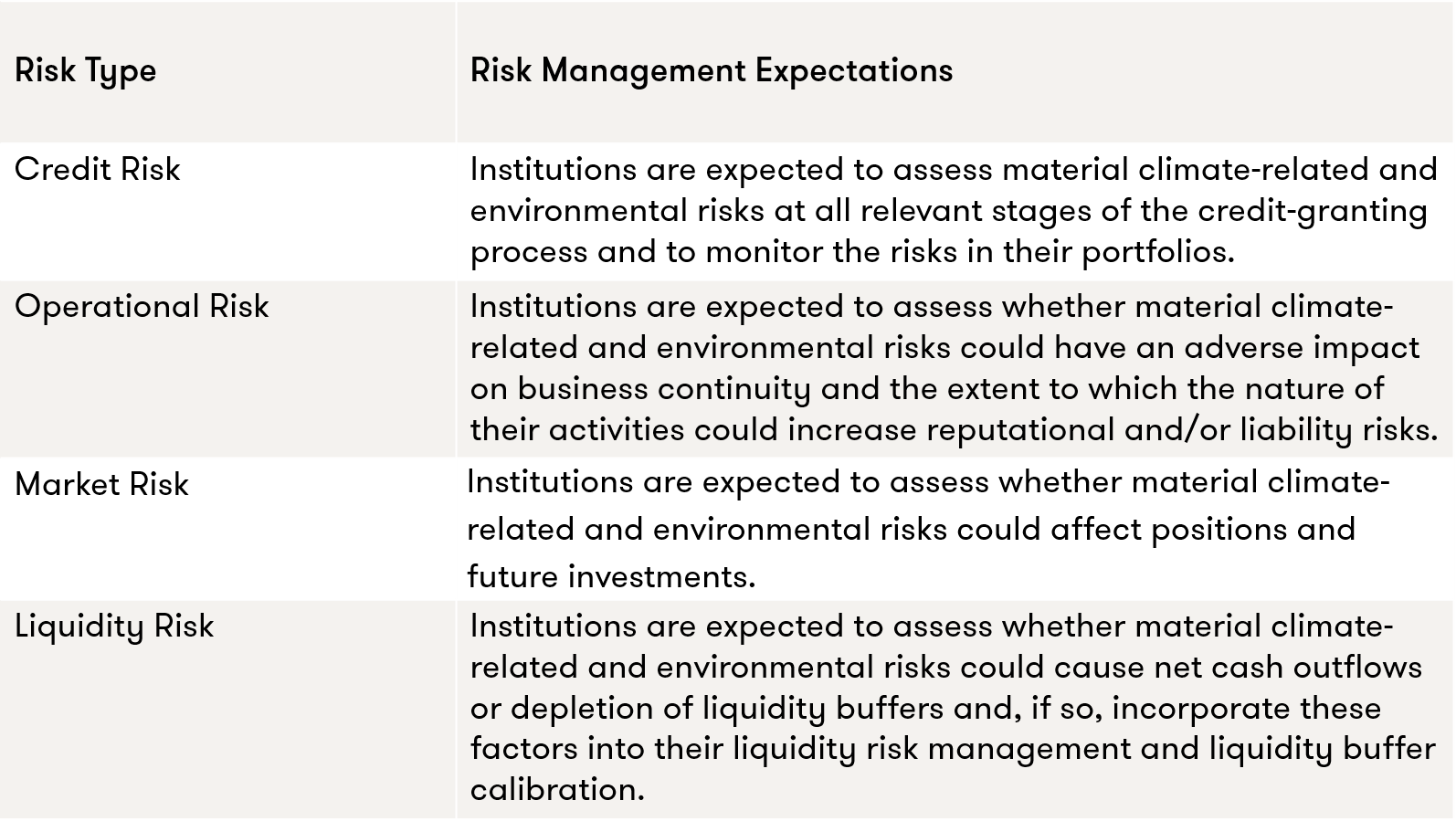

Institutions are expected to consider climate-related and environmental risks in their management of the following risks:

Additionally, institutions with material climate-related and environmental risks are expected to evaluate the appropriateness of their stress testing, with a view to incorporating them into their baseline and adverse scenarios for all relevant processes including the Internal Capital Adequacy Assessment Process, Internal Capital Adequacy Assessment Process, Recovery Planning and Wind Down Planning.

Disclosures

For the purposes of their regulatory disclosures, institutions are expected to publish meaningful information and key metrics on climate-related and environmental risks that they deem to be material.

Why Grant Thornton?

Grant Thornton’s Financial Services Risk, Consulting and Advisory teams are comprised of dedicated experts who are experienced in supporting banks and investment firms with a variety of regulatory and ESG challenges.

In particular, our industry-leading Prudential Risk, ESG experts and Consulting team understands that regulation continues to drive the strategic agenda for banks and investment firms. ESG and other sustainability related areas are likely to be high on the regulatory agenda for years to come. They specialise in assisting clients across the financial services sector in navigating through the maze of regulation and support clients to identify regulatory obligations and work towards full compliance balanced with your business needs.