Receive the latest insights, news and more direct to your inbox.

The Agile Approach: Being Change-ready during Economic Uncertainty

Disruptive business environments and diverse stakeholder needs warrant a re-evaluation of current project management practices. In the current economic environment, organisations must be able to manage change at unprecedented rates to remain relevant and ensure business growth. Having the correct project management framework not only allows for this flexibility but also future-proofs organisations.

Agile project management can help organisations transform their project delivery. The Agile approach involves breaking projects into phases (sprints), with emphasis on collaboration and iterative improvement. Working in an Agile way allows organisations to master constant change. It is a perfect fit for situations where problems are complex, solutions are multifaceted and unclear and requirements keep changing.

The Agile methodology is created on the principle of responsiveness and scalability to tackle dynamic requirements. It is focused on delivering the features that have the greatest business value first, and then getting feedback from end-users in real-time. An Agile approach prioritises collaborative and cross-functional teams, quality over rules and the embrace of change. As Agile adoption surges across industries, decoding the ways in which it is benefiting business and how these can be replicated is imperative.

The State of Agile

The latest State of Agile report published by Digital.ai shows notable trends in Agile practice as organisations scale Agile beyond software development to the entire organisation, particularly in the digital transformation and change management domains.

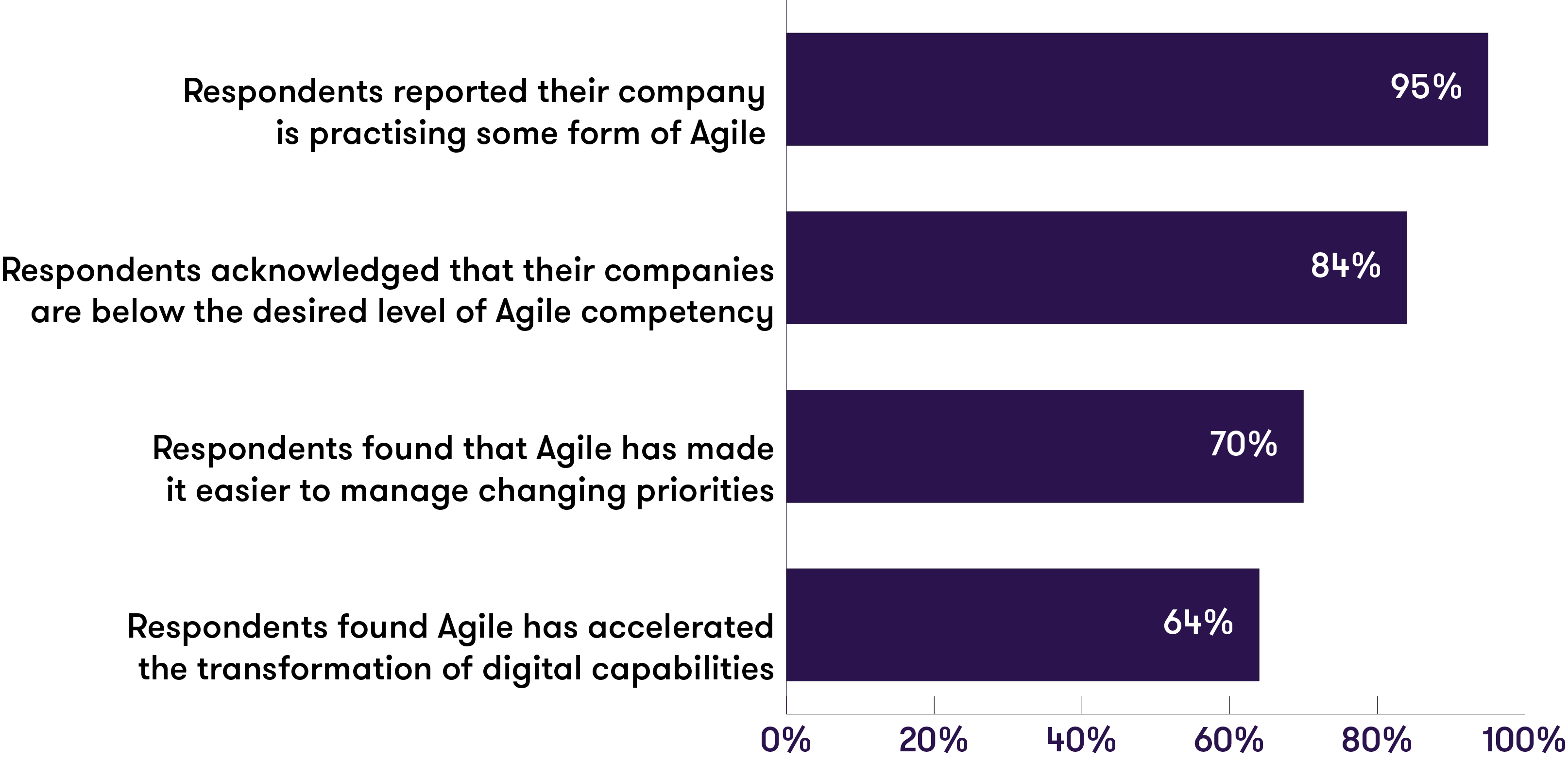

As depicted in the graphic below, of the 3220 respondents surveyed globally, 95% reported their companies were practising some form of Agile. Of these respondents, 84% acknowledged their companies were below the desired level of Agile competency. However, 70% of respondents still found Agile enabled easier management of changing priorities, and 64% found it accelerated digital transformation. If implemented well, the benefits of Agile can accrue to the entire organisation.

Building Resilience into Project Delivery with Agile

In recent years, Agile has taken project management and software development by storm. While established project management methods such as Waterfall are traditionally suitable for linear projects with low-client involvement, they are often outdated in today’s dynamic and fast-moving project environments.

The domination and familiarity of such traditional methods over many decades generates considerable resistance to change, making any change in ways of working understandably daunting. However, a cultural reorganisation or recalibration of business mindsets can facilitate the transition from traditional project management to Agile.

Developing inner agility is a key for leading Agile projects. Reactive mindsets are an outside-in way of experiencing the world based on reacting to circumstances and competitors. Proactive or self-authoring mindsets are an inside-out way of experiencing the world, characterised by a disposition toward taking intentional action.

When it comes to managing projects, a proactive mindset believes that obstacles can be removed and all eventualities can be prepared for, even before they occur. Agile organisations leverage this proactive mindset to tackle problems differently. They break down problems into smaller components and consciously tackle those head on, show less rigidity to change, set small-scale goals, celebrate wins, engage in frequent iterations to add incremental value and support creative teams to outperform autocratic leadership.

Managing projects using Agile methods requires buy-in at all levels – from the project team to senior leadership. However, the adaptation of Agile must be carefully managed. A major cause of failed Agile projects is when the bigger picture is lost somewhere along the process of carrying out small incremental changes. This oversight can lead to team disengagement and a shift in focus to short-term project targets rather than long-term organisational benefits.

Certain key characteristics are present in Successful Agile projects. These include a network of empowered teams in a dynamic people model led by actionable strategic plans and an environment that operates in rapid iterations, prioritises continuous learning and is supported by next-generation technology, such as artificial intelligence, blockchain, the internet of things (IoT) and robotics.

There is not a single straightforward to successful project delivery. However, when businesses choose the Agile route, it becomes easier to keep talent and leadership involved through an all-in approach via structured, iterative waves, to reduce risk through synergistic feedback and to retain focus on the bigger picture.

How Grant Thornton Can Help

With further market volatility on the horizon, now is the time to optimise project delivery through Agile. Drawing on our extensive industry knowledge, Grant Thornton’s Agile Project Management provides a best-fit approach to respond to the challenges of a rapidly changing industry. We are experienced in using Agile to deliver transformational change, provide Project Management Office (PMO) support, assess organisational agility, manage risk, improve performance, and enable cost optimisation. Our approach focuses on continuous iteration and growth with a clear view of the broader success metrics.

Contact us today to learn how Grant Thornton can help transform your organisation.