Sign up for expert insights, industry trends, and key updates—delivered straight to you.

The Digital Services Act (DSA) is a proposed piece of legislation by the European Union that aims to modernize and harmonize the rules governing digital services across the EU.

The DSA is part of a broader package of digital regulations, including the Digital Markets Act (DMA).

Key objectives

- To create a safer digital space in which the fundamental rights of all users of digital services are protected;

- Create a safer online environment for users, promote innovation and fair competition, and increase the accountability of digital services providers.

What are the key goals of the Digital Services Act?

| Affects / Impacts | Benefits |

|---|---|

|

Citizens |

Better protection for consumers and their fundamental rights online.

Establish a powerful transparency and a clear accountability framework for online platforms.

Mitigation of systemic risks, such as manipulation or disinformation. |

|

Providers of digital services |

|

|

Business users of digital services |

|

|

Society at large |

Which providers are covered?

- Intermediary services: Internet access providers, domain name registrars

- Hosting services: Cloud and webhosting services

- Online platforms: Online marketplaces, app stores, collaborative economy platforms and social media platforms

- Very large online platforms: Risks in the dissemination of illegal content and societal harms

View the list of new obligations

Stages / tasks of the external audit of a VLOP under the DSA

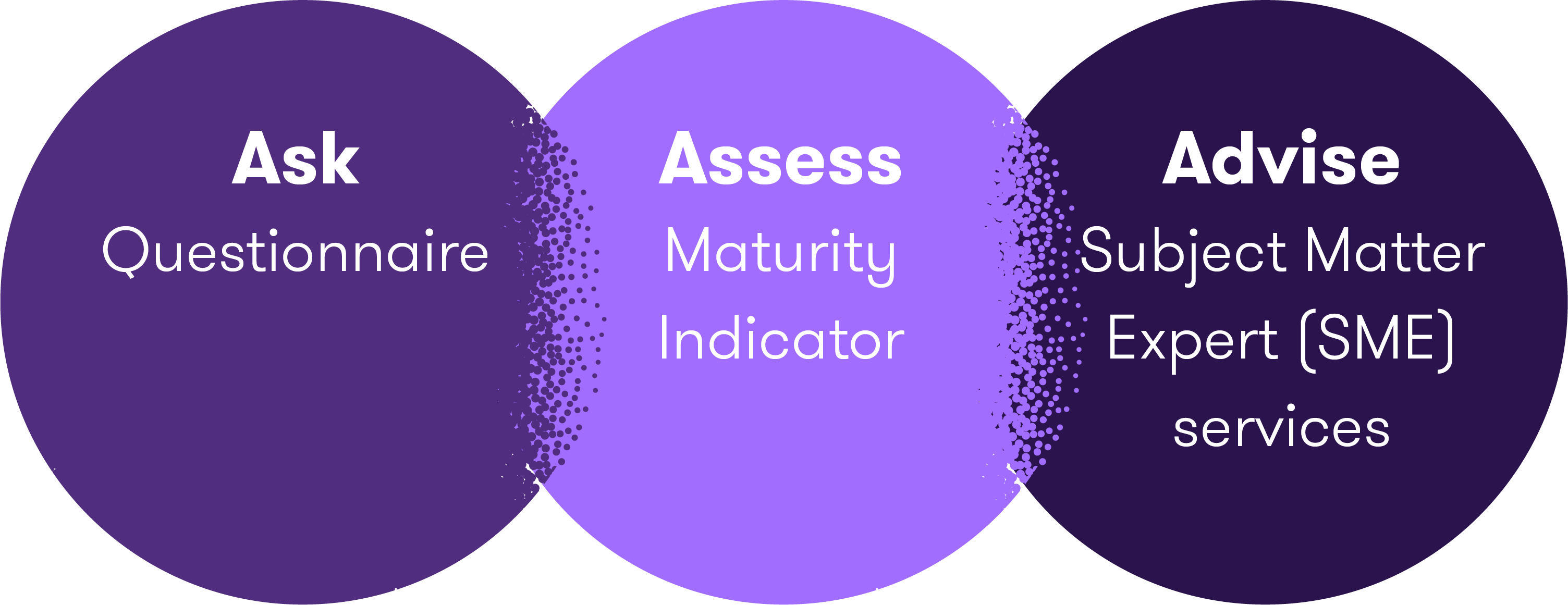

Maturity Assessment will enable our clients to diagnose their maturity / readiness as regards Digital Services Act (DSA) and establish a recommended path towards improvement.

General Maturity Assessment Process

- Reports and Diagnostics are composed of Multiple Dimensions critical for VLOPs to comply to DSA;

- A point system and weighting is applied to all question responses in every Dimension;

- A score range is mapped to the weighting of responses and assigned to every Dimension from Nascent to Leading;

- An Overall Score range is plotted on a Maturity Indicator;

- Overall Maturity Score is divided into 4 ranges based on points - Nascent, Developing, Maturing and Leading;

- Clients are offered a SME to provide personalised recommendations and richer insights.

Next steps and how we can help

Grant Thornton Ireland are well positioned to assist your firm with Digital Services Act queries. We have the experience and expertise to support you in embedding the Act’s requirements into your entity to ensure adherence to the new regulatory requirements.

Our market leading team of regulatory professionals can also provide support with a full fitness check of your firm in comparison to the wider regulatory expectations regarding DSA. From bespoke advice to large-scale projects, our subject matter experts are here to help.