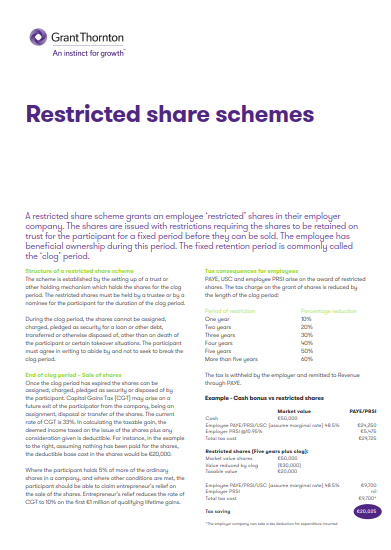

A restricted share scheme grants an employee “restricted” shares in their employer company. The shares are issued with restrictions requiring the shares to be retained on trust for the participant for a fixed period before they can be sold. The employee has beneficial ownership during this period. The fixed retention period is commonly called the ‘clog’ period.

In our document, we look at:

Also appears under...