Those with a reporting obligation, that is “Reporting Financial Institutions” (‘RFIs’) should compile and validate the reportable account information for inclusion on both the FATCA/CRS reports.

What should FIs do?

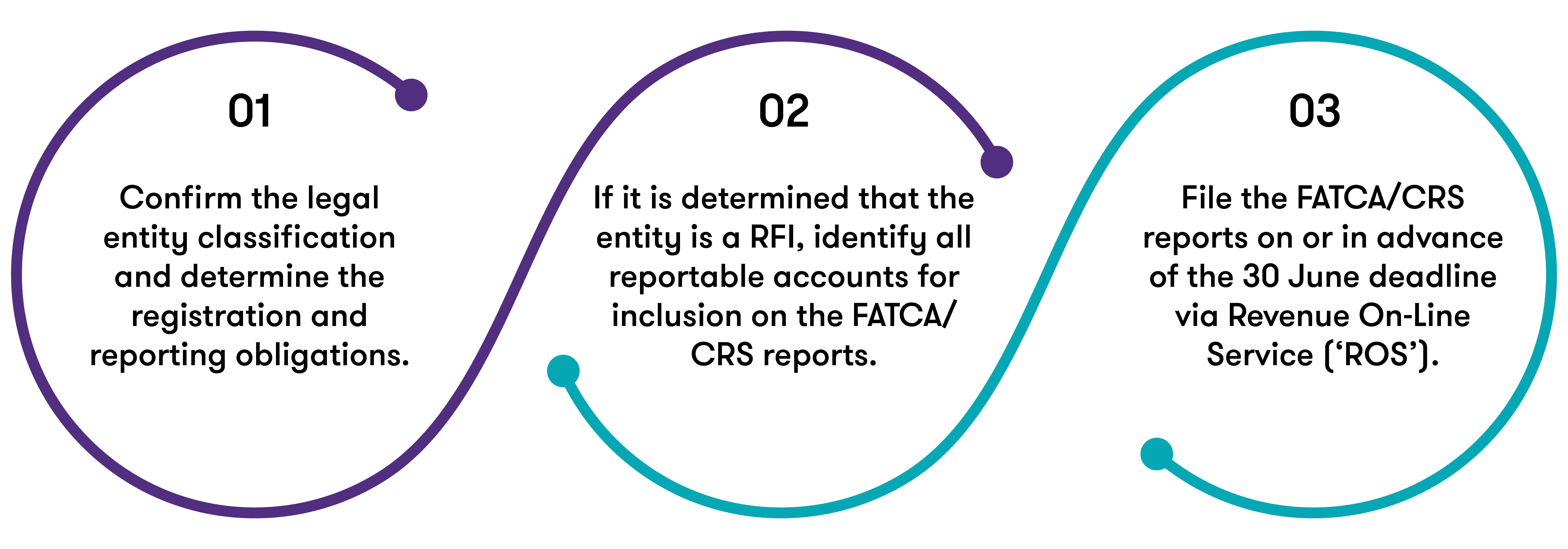

In advance of the deadline, FIs should take the following steps to ensure compliance with FATCA and CRS:

To ensure compliance and avoid fines and/or penalties, it is vital that the information is accurate and complete and the reports are filed on time.

Other Considerations for Reporting

The Internal Revenue Service (‘IRS’) and the Organisation for Economic Co-operation and Development (‘OECD’) often issue updates to the FATCA and CRS report filing guidelines respectively, which may be subsequently implemented by Irish Revenue.

One such recommendation is the release of an update to the XML schema by the OECD that RFIs are required to use when submitting CRS reports for the 2020 reporting period, which have been incorporated into the CRS filing guidelines by Irish Revenue. Therefore, it is important that RFIs keep up to date and be familiar with the latest FATCA and CRS reporting guidance issued by Irish Revenue.

How can we help?

Our Financial Services Tax team supports clients across the financial services industry with identifying their reporting requirements under FATCA and CRS and assistance with compiling and validating their reportable information. We provide a range of services from legal entity classification analysis, reporting and advice on and assistance with compliance obligations.