The debt warehousing scheme now includes income tax liabilities which normally fall due on 31 October 2020. This means that payments of the balance of income tax due for 2019 and preliminary tax for 2020 may be deferred, or known as ‘warehoused’, for up to 12 months’, interest free. A lower 3% reduced interest rate will apply thereafter to any outstanding payments until they are paid in full.

It may also be possible to warehouse the balance of income tax due for 2020 and 2021 preliminary tax.

How to qualify for income tax liabilities

The scheme is available to self-assessed taxpayers who expect their total income for 2020 will be less than 75% of their total income for 2019 as a consequence of Covid-19 restrictions, and they are unable to pay their income tax liabilities.

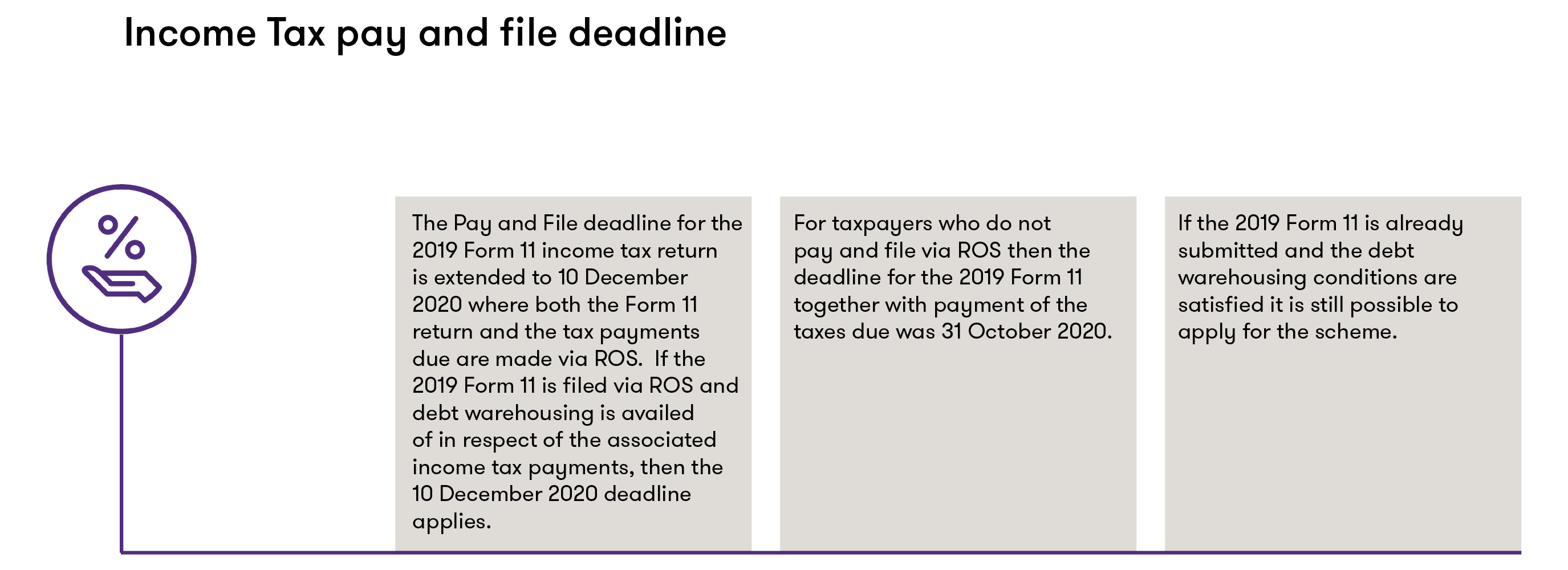

Taxpayers wishing to avail of the debt warehousing scheme must make a declaration with their 2019 Form 11 stating that their 2020 income is expected to be less than 75% of their total income for 2019 as a direct consequence of the Covid-19 restrictions.

We understand that the declaration is to be made on ROS as part of the Statement of Net Liabilities, the facility to make such declaration is expected to be available from 9 November 2020.

If a taxpayer did not meet their 2019 preliminary tax obligations, then the balance of income tax due for 2019 cannot be warehoused. However, by concession, Revenue are allowing these cases up to 10 December 2020 to apply and agree a Phased Payment Arrangement (PPA) and to avail of the reduced interest rate of 3% on the 2019 tax liability.

Taxpayers who were not self-assessed to income tax in 2019, but are of the view that they cannot pay their 2020 income tax liabilities as a result of the impact of Covid-19 restrictions, the debt warehousing scheme may be available provided that they contact Revenue on or before 10 December 2020.

If it later becomes known that the total income for 2020 was not less than 75% of the 2019 income as a consequence of Covid-19 restrictions and therefore the declaration was incorrect, the full tax liability will be removed from warehousing. The due date will revert to 31 October 2020 and interest of 8% will apply.

Obligations

Continued eligibility for warehousing of tax debts is conditional on the filing of all tax returns and payment of all tax liabilities that fall due while the warehousing scheme is in place.

If there are difficulties meeting tax return filing obligations due to Covid-19 the advice from Revenue is to submit all returns as they are due on a best estimate basis. If there is a difficulty in paying tax liabilities as they fall due, engagement with Revenue is key. Failure to pay tax liabilities and file returns due can result in Revenue removing your income tax liabilities from the warehouse scheme.

What next

Contact your Grant Thornton adviser to learn more and to discuss how we can assist you in availing of the debt warehouse scheme for your tax debts.