Sign up for expert insights, industry trends, and key updates—delivered straight to you.

On 22nd March 2021, the EU Council introduced "DAC7”, or the 7th Directive (2011/16/EU), on Administrative Cooperation, which enables EU Member States to address some of the perceived negative aspects of the digital economy, by extending the scope of existing exchange of information provisions between Member States, and thus ensuring greater transparency on cross border transactions. DAC7 has been given effect under Irish law through Finance Acts 2021 and 2022.

Over recent years the digitalisation of global economies has grown at pace. The cross border nature of such activities across digital platforms has also created a challenging scenario for tax authorities to enforce domestic tax rules and ensure tax compliance.

The new rules provide for Digital Platform Operators to collect information on reportable sellers utilising their platforms for Relevant Activities, and to annually report such information to the competent tax authority (e.g. the Irish Revenue Commissioners), who will share this with other relevant Member States.

Relevant activities

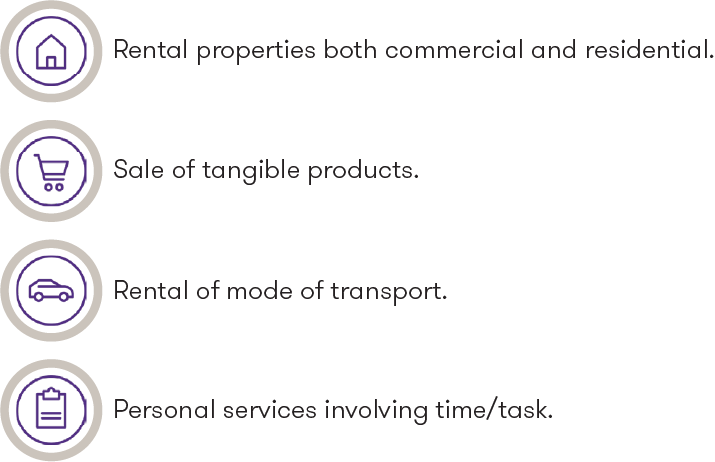

‘Platform Operators’ are generally websites, applications, mobile applications etc that allow sellers to connect with customers for the provision of the sales of goods and services including:

Exclusions

Platform Operators are not required to report on certain sellers including:

- Listed companies;

- Government and state bodies;

- Sellers with more than 2,000 letting transactions per annum;

- Sellers with fewer than 30 transactions / €2,000 in sales per annum; and

- The processing of payment, advertising and redirecting activities.

Reporting Platform Operators

“Reporting Platform Operators” are those which are either tax resident or incorporated in an EU Member State, or have a place of management or permanent establishment in a Member State.

Platform operators with no situs in a Member State may still have an obligation to report where they facilitate the carrying out of activities by sellers, or the rental of commercial/residential property located in a Member State.

Information to be disclosed

The reporting information includes both domestic and cross-border commercial activities. The data collected from the sellers should be verified in due diligence procedures by the platform operators, as laid down in the directive. In a number of cases this will necessitate additional information collection by the platform operators for existing sellers. The information on relevant Activities to be reported includes;

- Personal details of sellers, name and address, date of birth, etc;

- VAT and tax identification number;

- Business Registration number;

- The existence of any permanent establishment through which relevant activities are carried out in the Union, where available, indicating each respective Member State, where such a permanent establishment is located;

- Details on the amount of consideration paid, fees/commissions charged and tax withheld;

- For property rental arrangements, details of the rental dates and addresses of the properties, etc.

Reporting

Relevant activities occurring on or after 1 January 2023 are in scope for reporting with the first reporting obligation for Platform Operators due on 31 January 2024.

Where there are delays in obtaining information from reportable sellers, and appropriate reminders have been sent, Platform Operators shall close the user account for any further transactions. Such closure should occur if 60 days have elapsed since the last reminder, without response from the Seller and re-registration should be blocked for as long as the seller has not disclosed the requested information.

Actions required

As 1 January 2023 has passed, Platform Operators may need to take immediate action to prepare themselves for the implications of DAC7 if they haven’t already done so. This includes:

- Reviewing their operations and business model to determine whether or not they may be within the scope of DAC7 reporting.

- Assessment of the amount of data collected for onboarding, payments, VAT and other purposes should be commenced.

- It will also be important to evaluate the current capacity of the IT systems and processes and changes required.

- Explore the use of public interfaces for validating data and/or the possibility of outsourcing due diligence procedures.

- The platform operators may need to reach out to a large number of platform sellers and potentially educate them about their tax responsibilities to file this information. This may also require them to review contractual relationships with the sellers.

- Implications of data protection should be evaluated for compliance with data retention rules such as GDPR.

Sanctions for non-compliance

Under Irish law, the penalties for missing the reporting deadline will include an initial penalty of €19,045 for the Platform Operator plus an additional penalty of €2,535 for each day a report remains outstanding.

Conclusion

In conclusion, while DAC7 will add significantly to the data collection and administration responsibilities of Platform Operators, in theory, provided Sellers are currently tax compliant, DAC7 should not impact their tax liabilities. However, the ever expanding sharing of information between tax authorities will undoubtedly increase the scrutiny of Sellers and resultant audit activity by tax authorities across the EU.

How can Grant Thornton help?

Contact your Grant Thornton adviser to discuss your obligations under DAC7 and how we can assist you in implementing effective processes to ensure that you fully satisfy your reporting requirements.