Is your business involved in both VAT exempt and VAT taxable activities with a 31 December accounting year end? If so, your annual VAT adjustment for 2021 is due to be submitted to Revenue on or before 23 July 2022.

Generally, businesses are entitled to full VAT recovery on costs attributable to their VAT taxable activities, no VAT recovery on costs attributable to their VAT exempt activities and partial VAT recovery on costs which relate to both VAT taxable and VAT exempt activities (general overheads).

There are several methods used to calculate a partial general overhead VAT recovery rate including: turnover, staff usage, floor area etc. For example, a business that derives its turnover from 60% VAT taxable activities and 40% exempt activities will be entitled to recover 60% of the VAT incurred on its general overhead costs.

The turnover basis is the standard basis for calculating a partial general overhead VAT recovery rate. The turnover basis must be applied unless this basis does not “correctly reflect the use” of overhead costs nor does it have “due regard” to the range of activities and supplies undertaken by the business. Taxpayers should consider the turnover basis first and if it is not suitable, they should consider other methodologies.

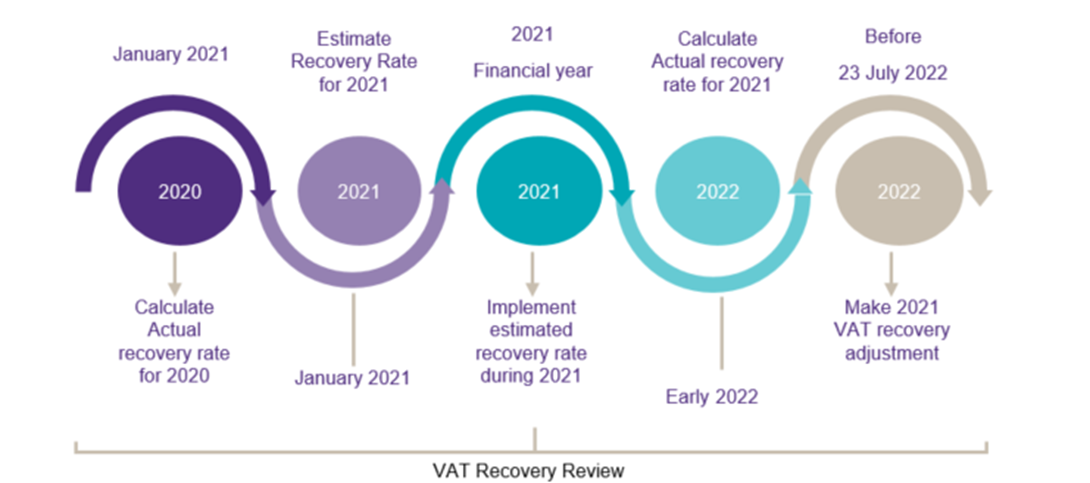

Where an “estimated” VAT recovery rate was applied throughout 2021 (usually based on the prior year’s actual rate), the actual VAT recovery rate for 2021 must now be calculated. Any VAT adjustment arising on the review should be made before 23 July 2022 (May/June 2022 VAT return due date). If the actual rate for 2021 is less than the estimated rate used, failure to adjust VAT by 23 July 2022 will result in an exposure to interest and penalties. If the actual rate is higher, an additional VAT input credit may be taken.

This exercise applies to the financial services sector, e.g. banking, insurance/reinsurance, investment funds but also to those involved in a mix of VATable and exempt business activities and non-business activities, such as medical/healthcare, property letting, educational activities, local authorities, etc.

As of 1 January 2021, businesses involved in supplies of certain financial services may have increased VAT recovery as a result of Brexit. This is due to the fact that certain financial services supplied to non-EU customers can be classified as “qualifying activities” and can now carry an entitlement to VAT deduction, improving the overall VAT recovery position of the business.

Methodologies and recovery rates used should be reviewed regularly; in particular, where the methodology applied has not been reviewed for a significant period, or where there have been changes in business activities, this will ensure the methodology currently applied remains appropriate.

If a business has recently commenced activities or is considering the VAT recovery position for the first time, Grant Thornton can advise on how best to approach this. Grant Thornton have assisted many clients over the years achieve very significant immediate and long term savings, as a result of carrying out annual VAT recovery rate methodology reviews. This is particularly pertinent in the current economic environment.