At a time when the global interest rate environment exhibited increasing trajectory and volatility, and further worsened by recent events that shook the stability of and confidence towards financial markets, financial institutions need to be on top of their game in managing its various risk exposures.

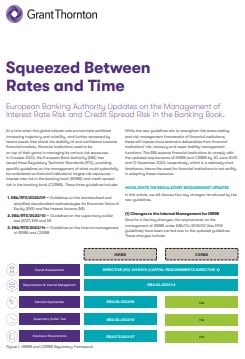

In October 2022, the European Bank Authority (EBA) has issued three Regulatory Technical Standards (RTS), providing specific guidelines on the management of what could potentially be considered as financial institutions’ largest risk exposures – interest rate risk in the banking book (IRRBB) and credit spread risk in the banking book (CSRBB). These three guidelines include:

- EBA/RTS/2022/09 – Guidelines on the standardized and simplified standardized methodologies for Economic Value of Equity (EVE) and Net Interest Income (NII)

- EBA/RTS/2022/10 – Guidelines on the supervisory outlier test (SOT) EVE and NII

- EBA/RTS/2022/14 – Guidelines on the internal management of IRRBB and CSRBB

While the new guidelines aim to strengthen the stress testing and risk management frameworks of financial institutions, these will impose more extensive deliverables from financial institutions’ risk, treasury and asset-liability management functions. The EBA expects financial institutions to comply with the updated requirements of IRRBB and CSRBB by 30 June 2023 and 31 December 2023, respectively, which is a relatively short timeframe, hence the need for financial institutions to act swiftly in adapting these measures.