Introduction

On 26 June 2021, the European regulatory authorities introduced new legislation, referred to as the Investment Firms Regulation EU 2019/2033 (‘IFR’) and Investment Firms Directive EU 2019/2034 (‘IFD’), which aims to establish a tailored prudential framework for investment firms.

This is the sixth publication in a series of articles by Grant Thornton and focusses on the impact of the revised remuneration requirements for investment firms.

The largest Systemic investment firms (Class 1 Firms) will continue to apply the current Capital Requirements Regulation (CRR) regime. The new prudential framework applies to investment firms that are not considered systemic by virtue of their size and/ or interconnectedness within the wider financial system, i.e. primarily Class 2 Firms (see the classification criteria in our previous publication). Small and non‐interconnected investment firms (Class 3 Firms) may receive regulatory requirements exemptions from the competent authorities, for example, with regards to variable remuneration instrument and deferral arrangements and the requirement to set up a remuneration committee. EBA guidelines, for example on the application of sound remuneration policies, re also not applicable to Class 3 Firms.

The new prudential regime introduces revised remuneration requirements. The overall purpose of these new requirements is to ensure that investment firms are managed in an orderly way, ensuring the safety and soundness of firms while also having policies and procedures that are proportionate to the size, internal organisation and nature of firms.

Regulatory Requirements

All firms that are subject to IFR and IFD should establish and apply remuneration policies for their ‘Identified Staff’ i.e. categories of staff whose professional activities have a material impact on the risk profile of the investment firm or of the assets that it manages. The details to be included in these policies are broadly in line with the requirements of the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD), for example, alignment with business strategy and independence of control staff. Firms should set appropriate ratios between the variable and fixed component of the total remuneration in their policies, taking into account the business activities of the investment firm and associated risks, as well as the impact that different categories of staff have on the risk profile of the investment firm. Gender-neutral policies is a new requirement under IFR/IFD. The other applicable remuneration requirements are contained within Articles 30, 32 and 33 of the IFD. Firms should also ensure that they disclose information regarding their remuneration policy and practices, including aspects related to gender neutrality and the gender pay gap, in line with Articles 46 and 51 of IFR.

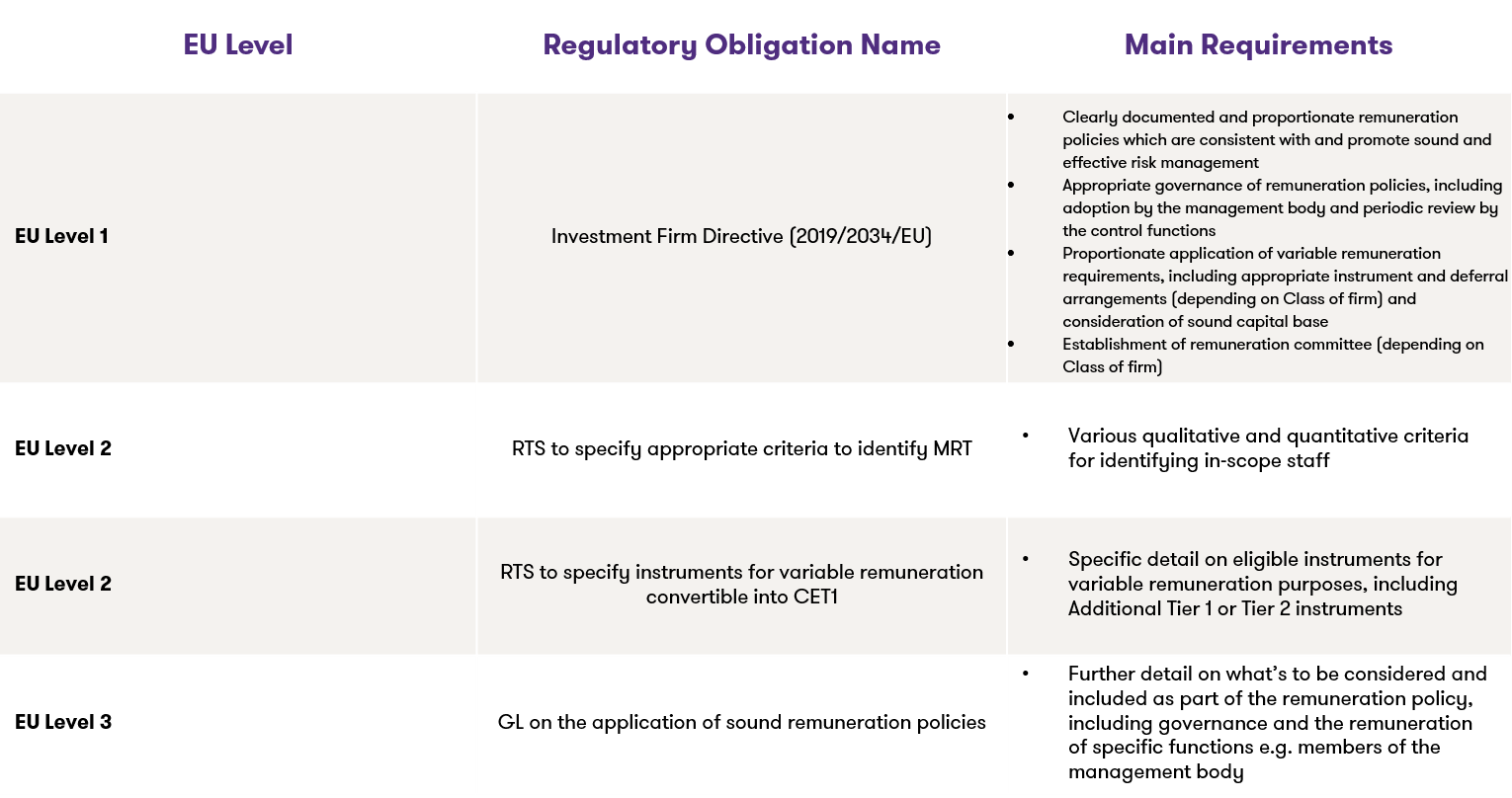

The table below shows the remuneration requirements in line with Articles 30, 32 and 33 of the IFD, and EBA Guidelines on sound remuneration policies under Directive (EU) 2019/2034, Draft Regulatory Technical Standards on criteria for Identified Staff under Directive (EU) 2019/2034 and Draft Regulatory Technical Standards on variable remuneration instruments for investment firms.

Remuneration Requirements

Derogations from the Regulatory Requirements

The various requirements on variable remuneration are to be applied on a proportionate basis by firms, in line with Article 30(3) of IFD. Currently Article 32(4) of IFD notes that the requirement to defer or pay certain percentages as financial instruments shall not apply to:

- An investment firm, where the value of its on and off-balance sheet assets is on average equal to or less than €100m over the four-year period immediately preceding the given financial year;

- An individual whose annual variable remuneration does not exceed €50,000 and does not represent more than one fourth of that individual’s total annual remuneration.

Derogations from Article 32(4)(a), allowing Member States to increase or decrease the €100m threshold once certain conditions are met, are provided in Articles 32(5) and 32(6) respectively. Further to this, in May 2021 the Department of Finance issued a Public Consultation Feedback Statement on the Exercise of National Discretions in which it was noted that the €100m threshold referred to in Article 32(4) can be increased to €300m subject to the conditions set out in Article 32(5) being met. It also noted that the threshold can be lowered as permitted by Article 32(6). The paper confirms that National Discretions are being exercised such that:

- The Minister for Finance will set the default threshold to €300m; and

- The Minister also designates that where the Central Bank of Ireland is satisfied that it is appropriate taking into account the nature and scope of the investment firm’s activities, its internal organisation, and, where applicable, the characteristics of the group to which it belongs, the Central Bank of Ireland may specify a lower threshold than €300m for a firm with regards to the discretion afforded under Article 32(5) & (6).

Next Steps

The new requirements as part of the IFR/IFD prudential framework will require updated policies and procedures for impacted firms, therefore impacted firms should identify and remediate any gaps early to be in a position to comply with the IFR/IFD regime when it comes into effect in June 2021.

In doing so, impacted investment firms should take into account the additional EU Level 2 and 3 regulatory items from the EBA as part of their analysis and remediation. These EBA guidelines are likely to be applicable from January 1st 2022, although this has not yet been fully confirmed by the EBA.

How Grant Thornton can help

Grant Thornton’s Financial Services Advisory teams currently support a number of investment firms with understanding, preparing for and implementing the new prudential framework in a practical hands on manner. In particular, our IFR/IFD experts have extensive knowledge of the relevant legislation and guidance and the challenges these pose to your firm.

Our IFR/IFD experts can help your firm assess its remuneration requirements arising from the new regime and advise on methods to ensure full compliance balanced with your business needs and tight implementation timelines. We have extensive experience of conducting remuneration reviews for investment firms, including preparation of Identified Staff methodologies and full reviews of remuneration policies and procedures.