Sign up for expert insights, industry trends, and key updates—delivered straight to you.

Revenue published guidance in February 2021 (Part 35A-01-01 of the Tax and Duty Manual) which provides additional details for taxpayers on how the TP rules will apply. One of the main aspects of the guidance is in respect of TP documentation and the requirements you need to meet in order to comply with the rules. Further updates were made by FA 2021 with respect to documentation requirements of an Irish branch and the carve-out of domestic transactions if certain conditions are met.

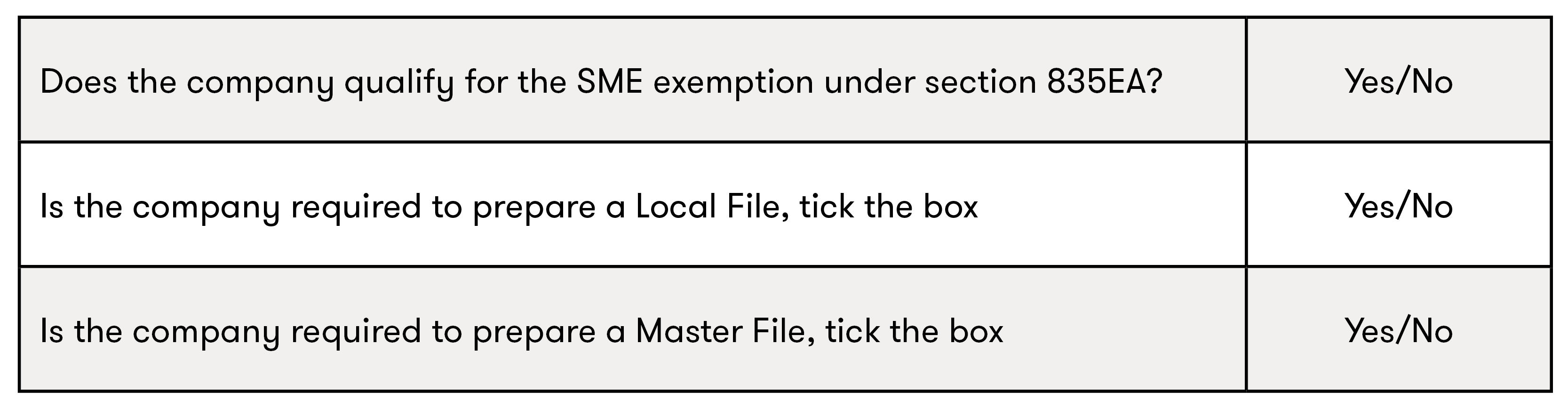

Irish Revenue have also revised the tax return from FY2020 onwards to include the following TP related questions:

We expect that Revenue will use the information these boxes provide to help decide who to target for future Revenue TP Audits.

Key Elements in the Revenue TP guidance

The key elements for Irish TP documentation requirements can be summarised as follows:

- The new rules have de minimis thresholds to ensure that the TP documentation requirements are proportionate. The thresholds are based on the annual consolidated global turnover of the group (not just Irish entities):

- Under the TP rules, taxpayers need to show that not only trading but also its non-trading income (with certain prescribed exceptions) are computed in accordance with transfer pricing legislation.

- The rules require taxpayers to prepare a master file and/or a local file. This TP documentation must be in place no later than the date on which the return for the chargeable period is due to be filed. The documentation must be provided to Revenue within 30 days of a written request.

- Where a taxpayer fails to comply within 30 days, a fixed penalty of €4,000 will apply. Where the taxpayer is required to prepare a local file or master file, the fixed penalty increases from €4,000 to €25,000 plus €100 for each day on which the failure continues.

- Small & Medium Enterprises [SMEs] are currently excluded from these requirements but they will be brought within the scope in the future by Ministerial Order. From that point, a small enterprise will not need any TP documentation and medium enterprises will need simplified documentation in respect of relevant transactions.

How can we help? – Our approach

Our transfer pricing team has extensive experience in assisting, leading and coordinating domestic and international TP projects across all industries. Our team comprises professionals from Ireland and other jurisdictions where similar OECD TP documentation regimes have been in place for some time. We know how to manage the issues involved in ensuring documentation meets the new Irish requirements.

We can also use the wider Grant Thornton Transfer Pricing Network to provide you with the best possible global solutions.

If you would like to know more, contact us today to discuss how we can support you through the new TP documentation compliance requirements.

Functional Analysis Review

Typically, our work involves a functional analysis review of your business operations to understand how the business operates and the key value drivers. We will liaise with your team to gather the majority of this information with a tailored questionnaire and follow up with calls.

TP Policy Design

Following our functional analysis review, we help you design the transfer policies you need, taking account of commercial sensitivities.

Sensible Advice

We will review the intercompany transactions and provide you with sensible advice on how to manage these between jurisdictions.

Documentation

We will draft the appropriate TP documentation. Having the right documentation in place, in a timely manner, is critical in the event of a challenge by tax authorities.

Dispute Resolution

If a tax authority challenges your TP position, we will be able to help find a resolution. This can be on a unilateral basis or in collaboration with our global transfer pricing teams, depending on the nature of the challenge.