The ever changing local statutory rules and the presence of multiple local providers, with varied processes, is adding to the complexity faced daily by payroll departments. The differing compliance requirements of the large multinationals, who are expanding into new markets, places a heavy burden on their payroll teams who may often need to set up a payroll compliance in a new country at short notice while ensuring the corporation remains compliant across all jurisdictions.

Our Services![Global payroll servics image.png]()

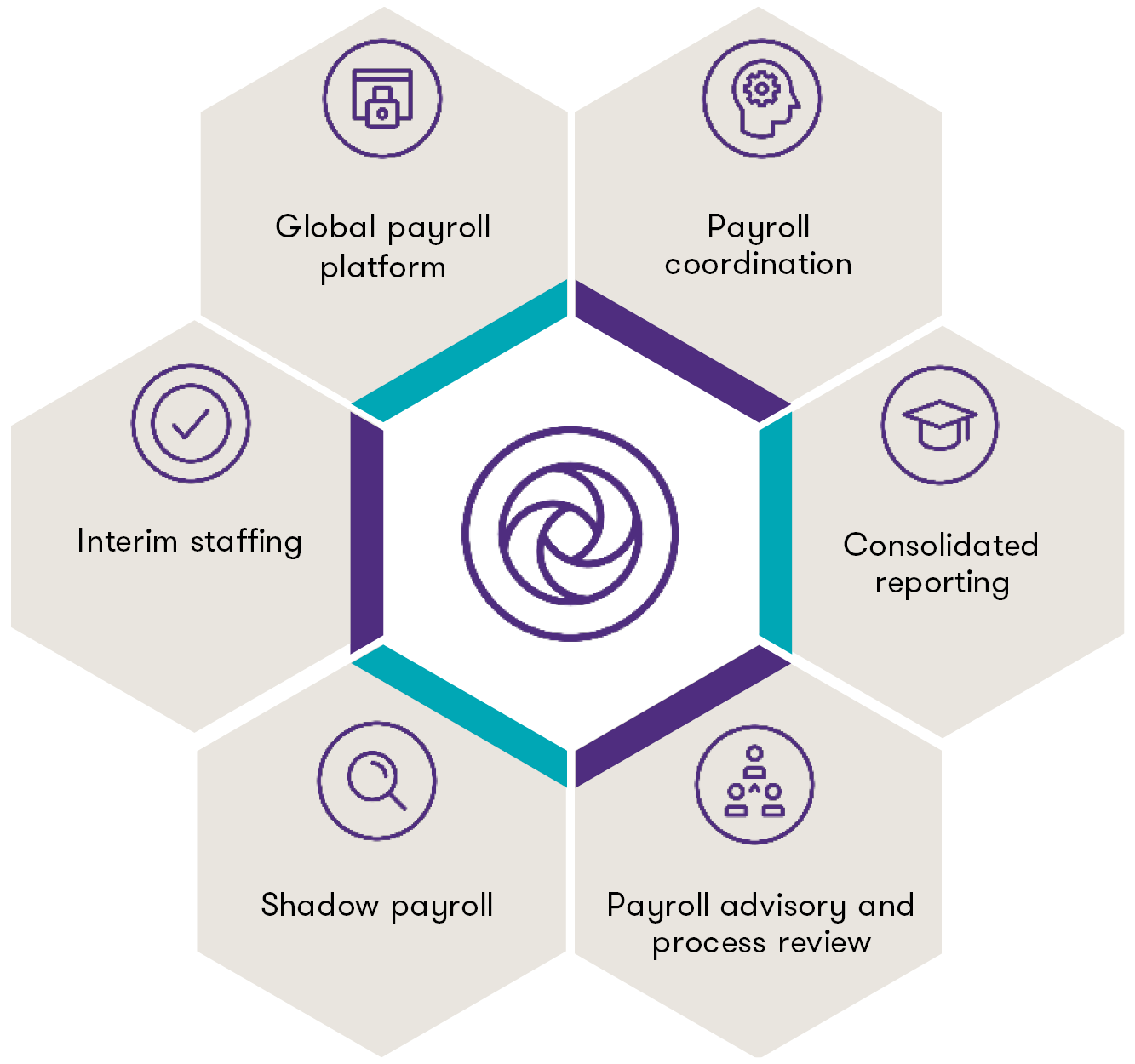

Our service model provides global consistency with well-coordinated delivery, responsive service and custom built technology to provide the benefits our clients told us they need. We are leveraging our 1000+ payroll specialists and tax professionals in over 140 countries worldwide to provide a connected approach covering clients pressing challenges including global mobility, tax and law.

Technology and automation play a significant part in the delivery of our service. We use a global payroll platform to manage your payroll process and team actions, offer standardized and bespoke reporting in local and global currency including payroll journals configured to our clients’ needs.

We offer payroll process reviews and interim staffing for specific complex projects when the client does not have the necessary experience internally or is simply short staffed for the additional workload.

Why Grant Thornton

Drawing on the power of innovation we offer flexible tailored service delivered through a single point of contact. This streamlined service allows our clients to focus on core business activities with greater peace of mind. Our global office network covers 140 countries enabling us to provide a quality service to rapidly growing multinational companies in local language.

Update your subscriptions for Grant Thornton publications and events.