Discover how US tax reforms and EU developments could reshape trade, taxation and strategy for Irish and European businesses.

As the new U.S. administration recalibrates its global trade stance, President Trump’s renewed focus on tariffs as a primary negotiating tool is reshaping international trade dynamics.

Recent measures have moved from speculation to clear intent. Key executive orders are already affecting industries worldwide.

This series cuts through the speculation to identify real and potential impacts for Ireland and Irish-based industry, explains how tariffs trickle through the economy and explores what businesses can do to mitigate negative impact.

Webcast

US tax reforms: Impact on Irish & EU businesses

Article

US tariffs take effect: What EU businesses must do now

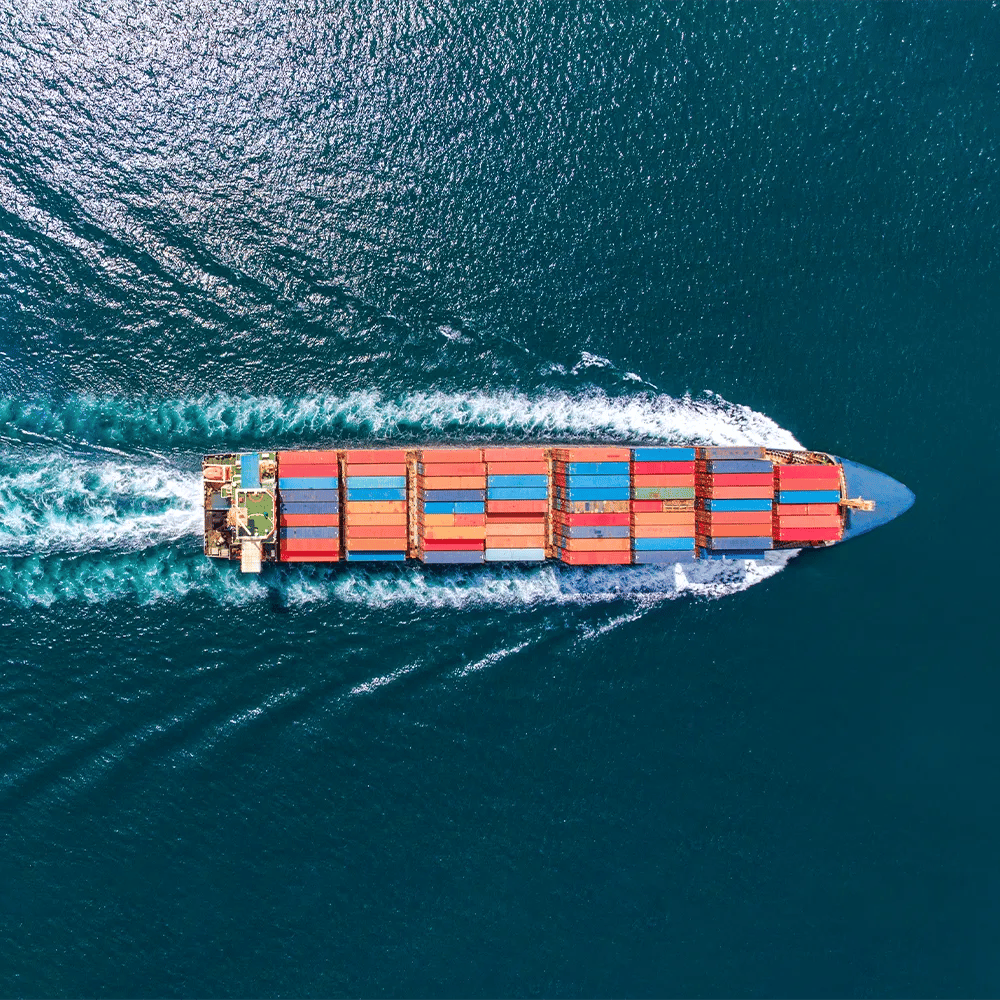

Understand the impact of new US tariffs on EU goods. Learn how to mitigate risks, reduce duties and protect your global supply chain.

Article

As Trump’s tariff front moves in, Ireland braces for impact

US tariffs pose a growing risk to Irish exports, jobs and tax receipts as businesses brace for disruption in food, pharma and tech sectors.

Article

New tariff paradigm

Explore how businesses can adapt to the new tariff paradigm with strategic supply chain adjustments, tax compliance, and pricing strategies in a shifting trade environment.

Article

Trade, tax and business strategy in uncertain times

Irish businesses face uncertainty with shifting US tariffs & tax policies. Learn how to adapt your trade & business strategy for resilience & growth.

Article

The domino effect: The implications of tariffs and trade wars

Tariffs and trade wars are disrupting global trade, raising costs, and creating uncertainty. Discover how these changes impact Ireland and what businesses can do.