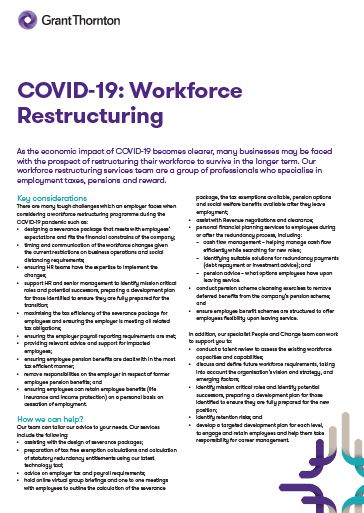

As the economic impact of COVID-19 becomes clearer, many businesses may be faced with the prospect of restructuring their workforce to survive in the longer term. Our workforce restructuring services team are a group of professionals who specialise in employment taxes, pensions and reward.

Key considerations

There are many tough challenges which an employer faces when considering a workforce restructuring programme during the COVID-19 pandemic such as:

- designing a severance package that meets with employees’ expectations and fits the financial constrains of the company;

- timing and communication of the workforce changes given the current restrictions on business operations and social distancing requirements;

- ensuring HR teams have the expertise to implement the changes;

- support HR and senior management to identify mission critical roles and potential successors, preparing a development plan for those identified to ensure they are fully prepared for the transition;

- maximising the tax efficiency of the severance package for employees and ensuring the employer is meeting all related tax obligations;

- ensuring the employer payroll reporting requirements are met;

- providing relevant advice and support for impacted employees;

- ensuring employee pension benefits are dealt with in the most tax efficient manner;

- remove responsibilities on the employer in respect of former employee pension benefits; and

- ensuring employees can retain employee benefits (life insurance and income protection) on a personal basis on cessation of employment..

![Subscribe button.jpg]()