Indirect Tax

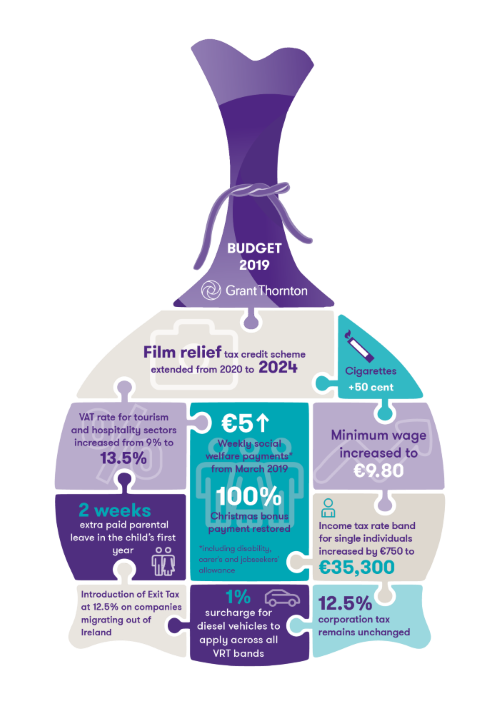

- The VAT rate applicable to the tourism and hospitality sectors will be returned to 13.5% from 1 Jan 2019, from the 9% rate which it has enjoyed from 2011.

- The 9% VAT rate is being retained for newspapers and sporting facilities. It will also now apply to electronic newspapers which are currently taxed at 23%.

- Excise duty: 50c increase on a packet of 20 cigarettes from midnight on 9 October 2018.

- VRT: extension of relief for hybrid vehicles until end of 2019.

- Introduction of 1% surcharge for diesel vehicles across all VRT bands with effect from 1 January 2019.

- Betting duty: increase from 1% to 2% with effect from 1 January 2019.

Corporation Tax

Minister Donohoe confirms Corporation Tax rate to remain, stating “Our longstanding 12.5% rate will not be changing”.

- EU Anti-Tax Avoidance Directive (ATAD) measures announced:

- introduction of Exit Tax at 12.5% on unrealised capital gains, where companies migrate tax residence or transfer assets offshore, leaving the scope of Irish tax; and

- Finance Bill 2018 to introduce a Controlled Foreign Company (CFC) regime.

- Three Year Start-Up Relief for companies extended until the end of 2021.

- Film Relief Tax Credit Scheme extended from 2020 to 2024, with proposed new

short-term 5% uplift for productions made in designated areas.

- Improvement of Accelerated Capital Allowances scheme for employer-provided fitness/childcare facilities.

- Introduction of Accelerated Capital Allowances for gas-propelled vehicles and refuelling equipment.